Unlocking TradingView Discounts 2025

Introduction to TradingView Discounts

TradingView is a leading platform for traders and investors, offering powerful tools for technical analysis and market insights. For those looking to enhance their trading strategies without breaking the bank, TradingView discounts can be a game-changer. This article will delve into the various ways you can save on TradingView subscriptions, ensuring you get the most out of this valuable resource.

Types of TradingView Discounts

TradingView offers several types of discounts that cater to different needs and preferences:

- Promo Codes: These are special codes that can be applied during checkout to receive a percentage off your subscription. Codes like TRADESMART15 and CHARTPRO20 offer discounts ranging from 10% to 20% on various plans.

- Annual Plans: Opting for an annual subscription often results in significant savings compared to monthly plans. This is a great option for those committed to using TradingView long-term.

- Student Discounts: Eligible students can receive special pricing by verifying their student status through third-party services like SheerID.

- Referral Programs: Participating in TradingView’s referral program can earn you bonuses or discounts on your subscription when you invite friends to join.

Maximize TradingView's Free Plan with Pineify's No-Code Solution

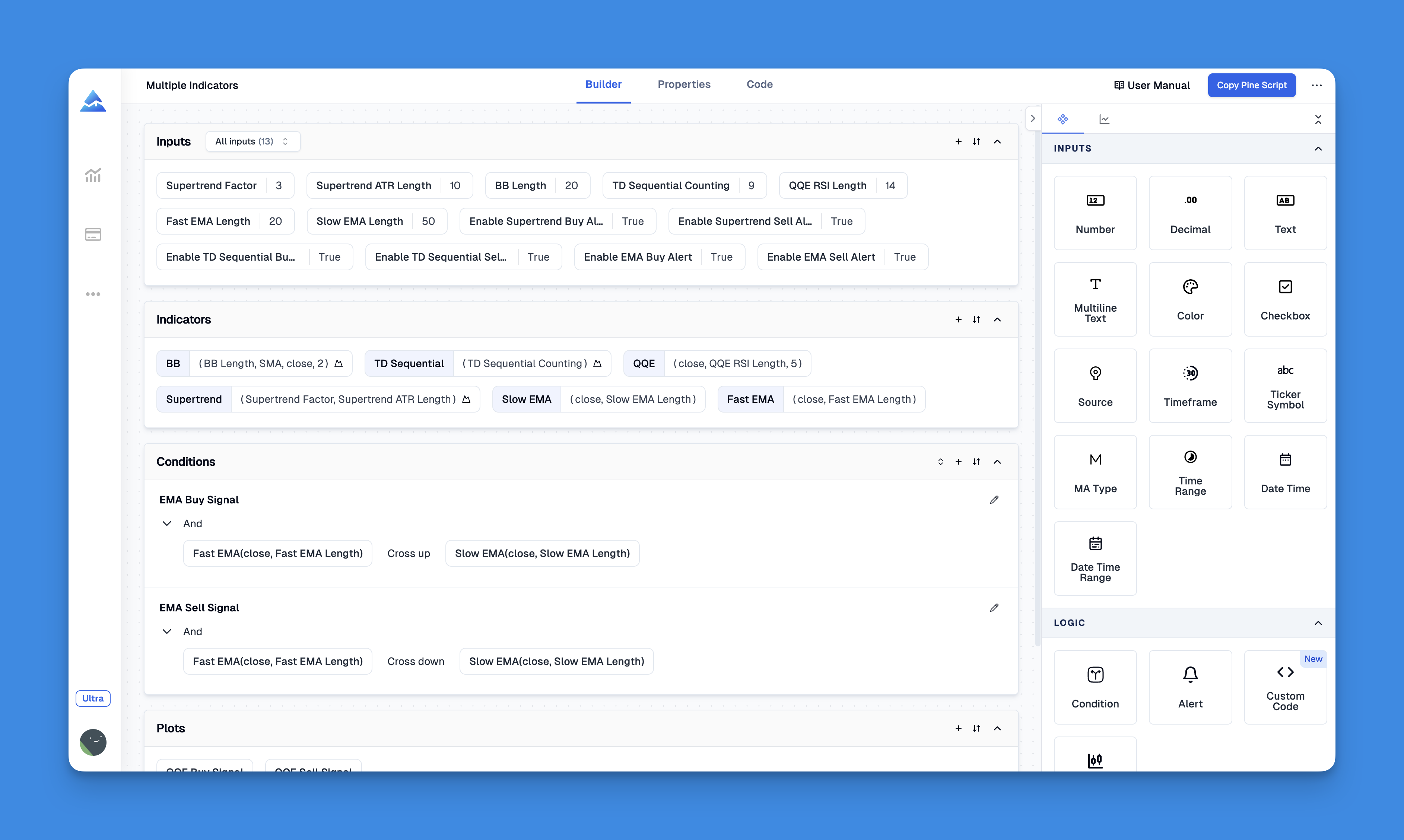

One of the most significant challenges for traders using TradingView is the platform's limitation on technical indicators, especially with the free plan. While premium subscriptions can be costly, there's now an innovative workaround that effectively serves as your unofficial TradingView discount for 2025: Pineify.

Pineify is a powerful tool designed specifically for TradingView users that allows you to create custom indicators and strategies without any programming knowledge. What makes this particularly valuable is that it works seamlessly with TradingView's free plan, essentially unlocking premium-like functionality without the premium price tag.

Website: Pineify

Click here to view all the features of Pineify.How to Find TradingView Discounts

Finding the best TradingView discounts requires some strategy:

- Coupon Websites: Sites like WorthEPenny and Couponzania offer a wide range of active coupons and promo codes for TradingView.

- TradingView Newsletter: Signing up for TradingView’s newsletter ensures you receive updates on new promotions and discounts directly in your inbox.

- Social Media: Keep an eye on TradingView’s social media channels for exclusive offers and limited-time deals.

Tips for Maximizing Savings

To make the most of your TradingView subscription:

- Combine Offers: While most platforms don’t allow multiple codes at once, look for bundled deals or special promotions that offer additional savings.

- Free Features: Explore TradingView’s free tools before upgrading to a paid plan to ensure you need the premium features.

- Community Engagement: Join online trading communities to stay informed about upcoming promotions and shared tips from fellow traders.

Conclusion

TradingView discounts are an excellent way to enhance your trading experience without overspending. By leveraging promo codes, annual plans, and referral programs, you can unlock a wealth of market analysis tools at a reduced cost.