Crafting a Winning Pine Script Strategy with Stop Loss

In the world of trading, Pine Script is a powerful tool for creating custom strategies on platforms like TradingView. One crucial element in any trading strategy is the stop loss, which helps manage risk by limiting potential losses. Here’s how you can effectively integrate a stop loss into your Pine Script strategy.

Understanding Stop Loss in Pine Script

A stop loss is a risk management technique used to exit a trade when it reaches a predetermined price level, preventing further losses. In Pine Script, you can implement a stop loss using the strategy.exit() function, which allows you to specify either an absolute price (stop parameter) or a relative distance from the entry price (loss parameter).

Implementing Stop Loss in Your Strategy

To set up a stop loss in your Pine Script strategy, follow these steps:

- Define Entry Conditions: Determine when you want to enter a trade based on specific market conditions.

- Set Stop Loss Levels: Decide on the price or percentage distance from the entry price where you want to trigger the stop loss.

- Code the Exit Conditions: Use

strategy.exit()to implement the stop loss logic.

Simplifying Stop Loss Implementation Without Coding Skills

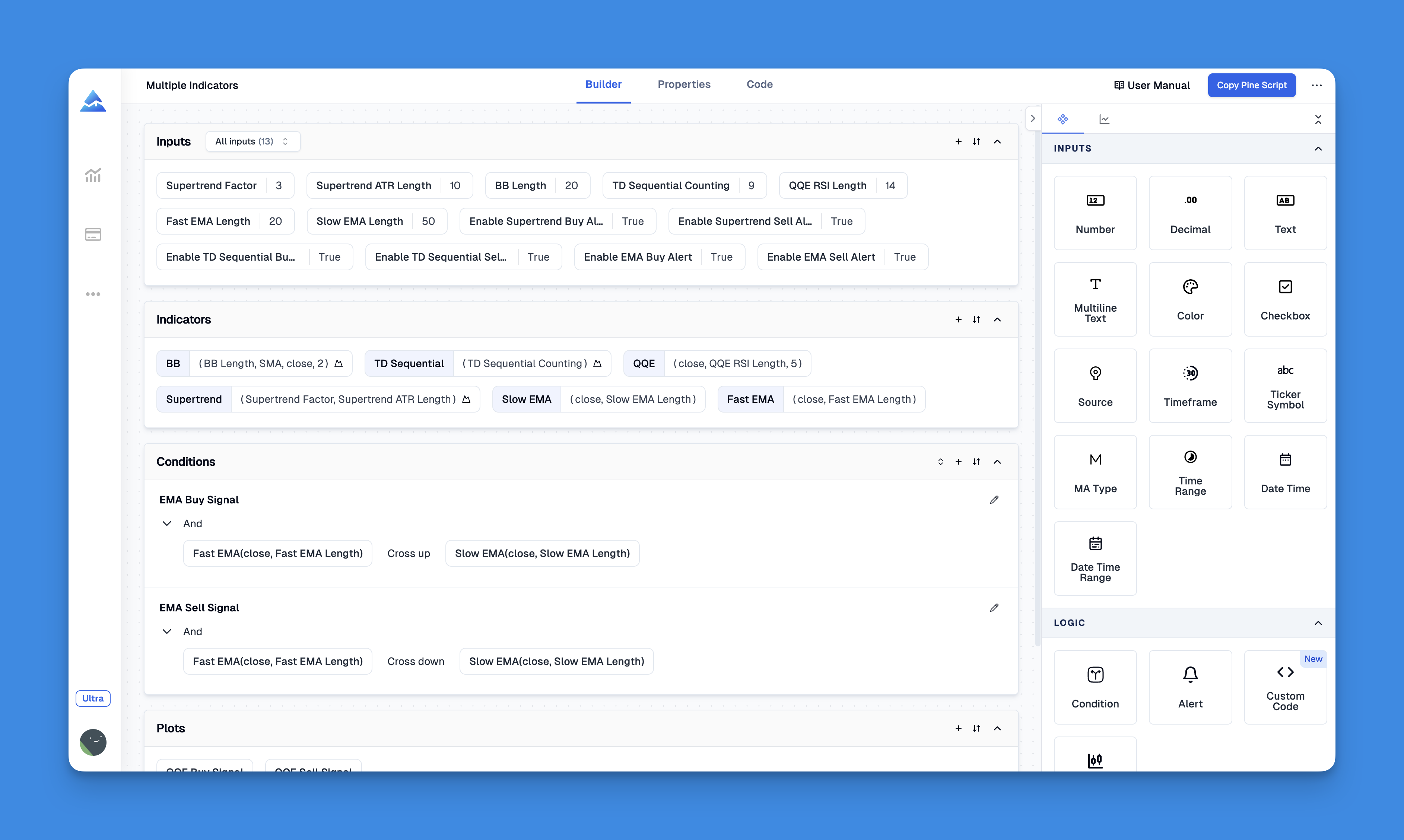

Trading strategy development traditionally requires extensive coding knowledge, especially when implementing crucial risk management components like stop loss orders. However, tools like Pineify are transforming this landscape by enabling traders to craft sophisticated Pine Script strategies with proper stop loss mechanisms—all without writing a single line of code.

Through Pineify's intuitive visual interface, you can construct complex trading conditions by combining multiple technical indicators, price action patterns, and market data points to create precise entry and exit rules. What truly sets this approach apart is the ability to implement comprehensive risk management through the platform's strategy tester, where you can easily configure market orders alongside take-profit and stop-loss parameters to protect your capital.

Website: Pineify

Click here to view all the features of Pineify.Example Code Snippet

Here’s a simple example of how to set a stop loss in Pine Script:

// Define entry conditions

strategy.entry("Long", strategy.long)

// Set stop loss level (e.g., 2% below entry price)

stopLossLevel = close * 0.98

// Implement stop loss using strategy.exit()

strategy.exit("Stop Loss", "Long", stop=stopLossLevel)

Advanced Stop Loss Techniques

Beyond basic stop losses, Pine Script offers more sophisticated options:

- Trailing Stops: These adjust the stop loss level as the market moves in your favor, ensuring you lock in profits while minimizing losses.

- Bracket Orders: Combine stop losses with take profits to manage both risk and potential gains effectively.

Tips for Effective Stop Loss Strategies

- Adjust Based on Volatility: Tighter stop losses in volatile markets can help prevent large losses.

- Test Different Levels: Experiment with various stop loss distances to find what works best for your strategy.

- Monitor Performance: Regularly review your strategy’s performance to refine your stop loss settings.

Conclusion

Implementing a well-designed stop loss in your Pine Script strategy can significantly enhance your trading performance by minimizing risk and maximizing returns. Whether you’re a seasoned trader or just starting out, understanding how to effectively use stop losses is crucial for success.