Mastering Pine Script Timeframe Input for Enhanced Trading Strategies

In the world of trading, flexibility and customization are key to creating effective strategies. One powerful tool in Pine Script that allows traders to tailor their approaches is the input.timeframe() function. This article will delve into the intricacies of using input.timeframe() to enhance your trading scripts, making them more dynamic and user-friendly.

What is input.timeframe()?

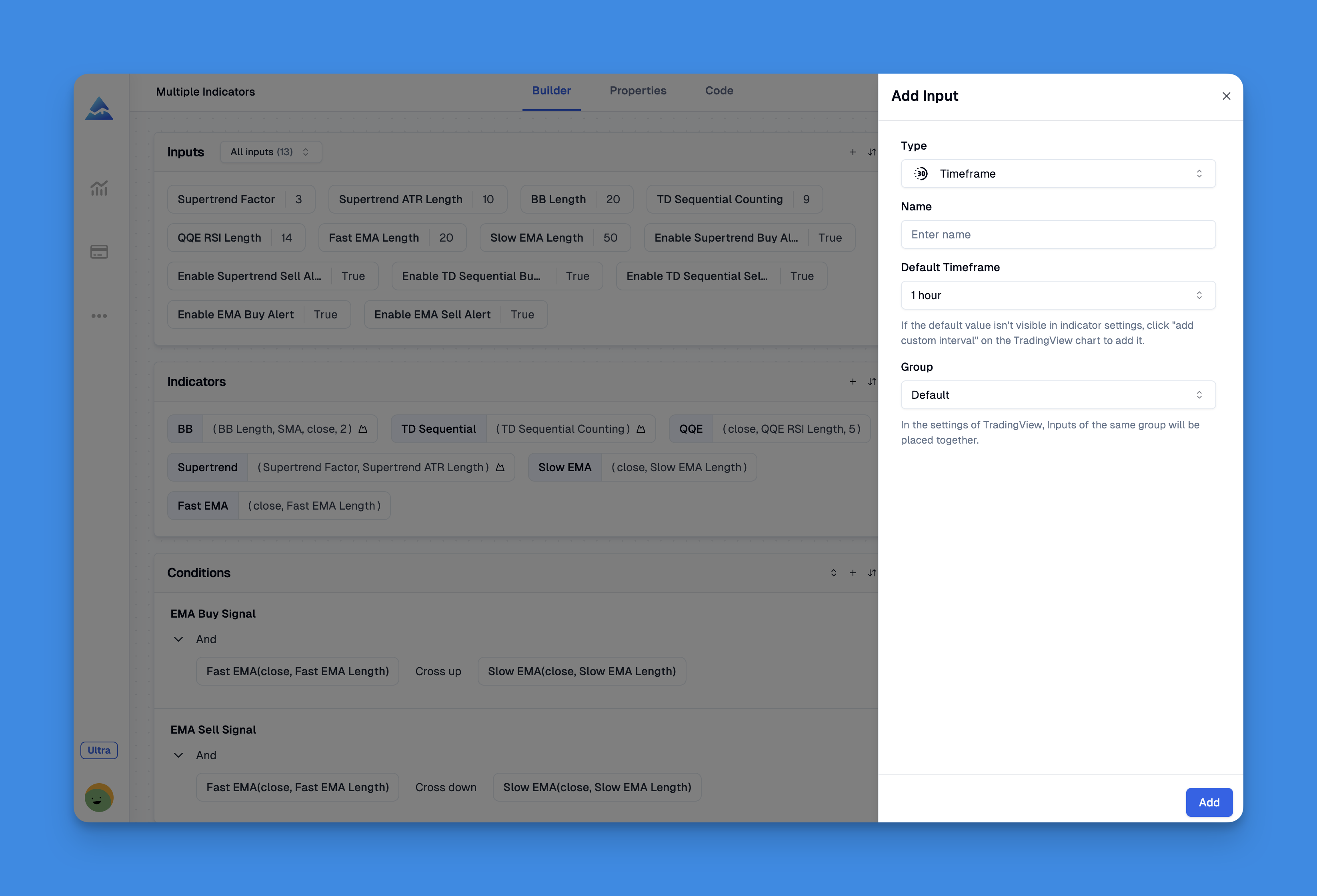

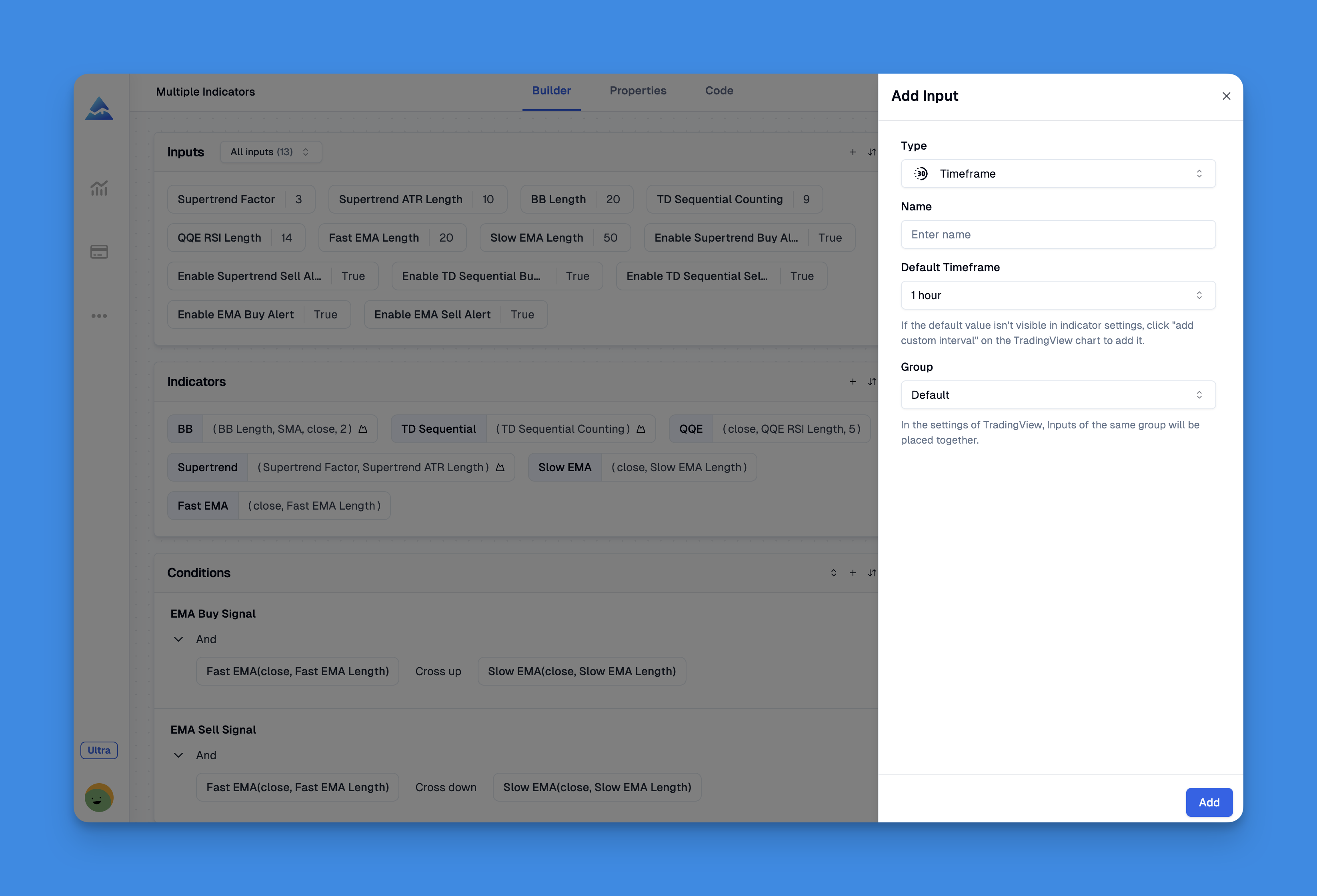

The input.timeframe() function in Pine Script enables users to select a specific timeframe for their trading strategies. It creates a dropdown menu in the script’s “Inputs” tab, allowing users to choose from various timeframes such as daily, weekly, or monthly. This feature is particularly useful when you want to analyze data across different timeframes without manually switching between them.

Syntax and Usage

The syntax for input.timeframe() is as follows:

input.timeframe(defval, title, options, tooltip, inline, group, confirm) → input string

Here’s a breakdown of the arguments:

defval: The default timeframe selected when the script is loaded.title: The label displayed next to the input field.options: A list of available timeframes for selection.tooltip: A brief description that appears when hovering over the input field.inline: Whether the input should be displayed inline with other inputs.group: The group under which the input is categorized in the “Inputs” tab.confirm: Whether a confirmation dialog should appear when changing the input.

Leveraging Multi-Timeframe Analysis Without Coding Limitations

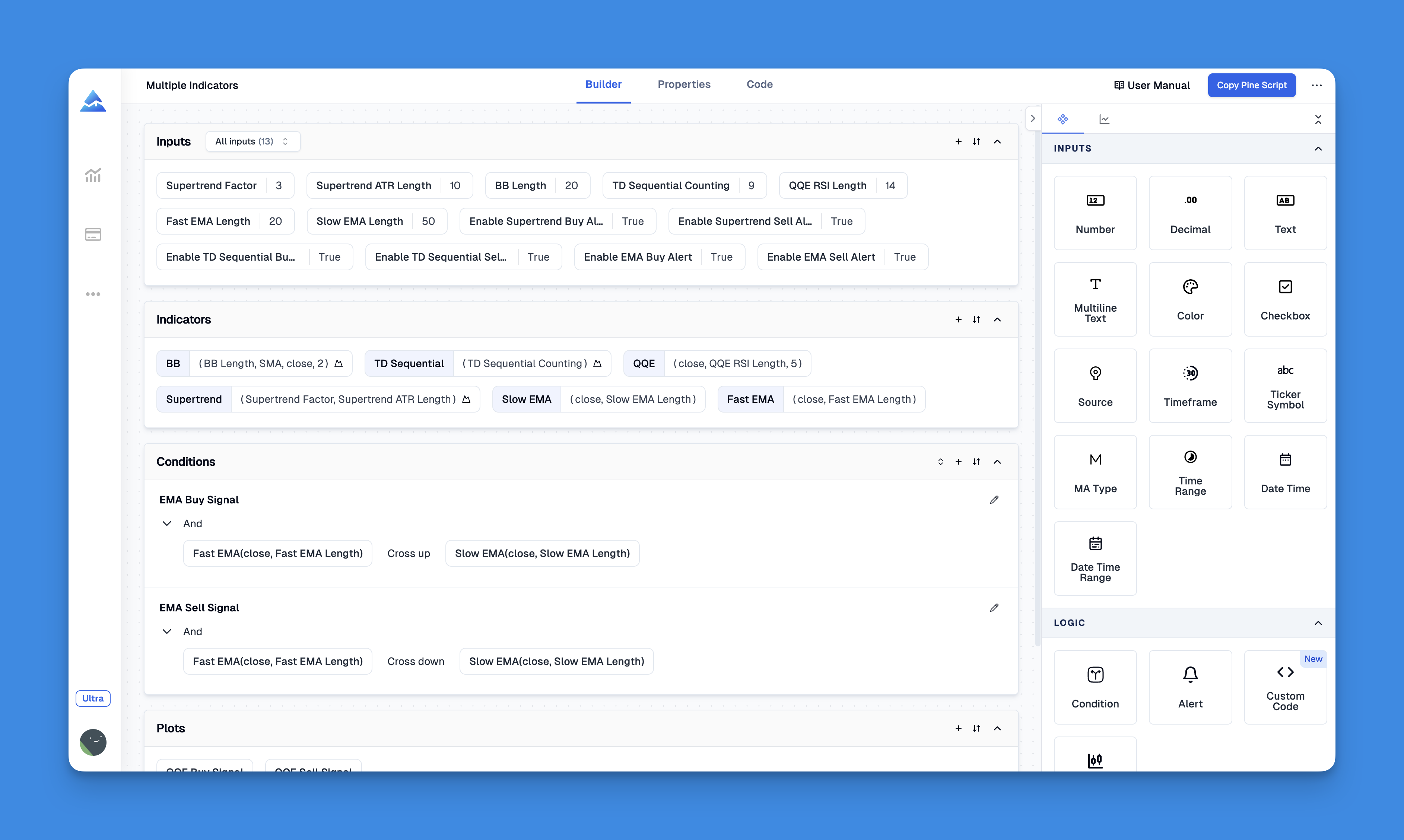

Trading across multiple timeframes has long been recognized as a powerful analytical technique that provides traders with a comprehensive market perspective. Traditionally, implementing multi-timeframe analysis through Pine Script required extensive coding knowledge and faced significant platform limitations. However, modern tools like Pineify have revolutionized this process, making it accessible to traders of all technical backgrounds.

When working with Pine Script timeframe inputs, one of the most valuable capabilities is the ability to reference different timeframes and symbols simultaneously in your analysis. This allows you to create indicators that compare momentum across various time horizons or generate signals based on confluence between timeframes. The challenge has typically been TradingView's inherent limitations on how many indicators you can add to a single chart.

Website: Pineify

Click here to view all the features of Pineify.Example Use Case

Here’s a simple example of how to use input.timeframe() to plot closing prices from a user-selected timeframe:

//@version=5

indicator("Timeframe Input Example", overlay=true)

i_res = input.timeframe('D', "Resolution", options=['D', 'W', 'M'])

s = request.security(syminfo.tickerid, i_res, close)

plot(s)

This script allows users to select a timeframe and displays the closing prices for that timeframe directly on the chart.

Benefits of Using input.timeframe()

- Flexibility: Users can easily switch between different timeframes without modifying the script.

- User Engagement: By offering customization options, users are more likely to engage with your script.

- Dynamic Analysis: It facilitates multi-timeframe analysis, which is crucial for identifying trends and patterns.

Conclusion and Call to Action

Mastering the input.timeframe() function in Pine Script can significantly enhance your trading strategies by providing a flexible and interactive way to analyze data across different timeframes. Whether you’re a seasoned trader or just starting out, incorporating this feature into your scripts can make them more appealing and effective.