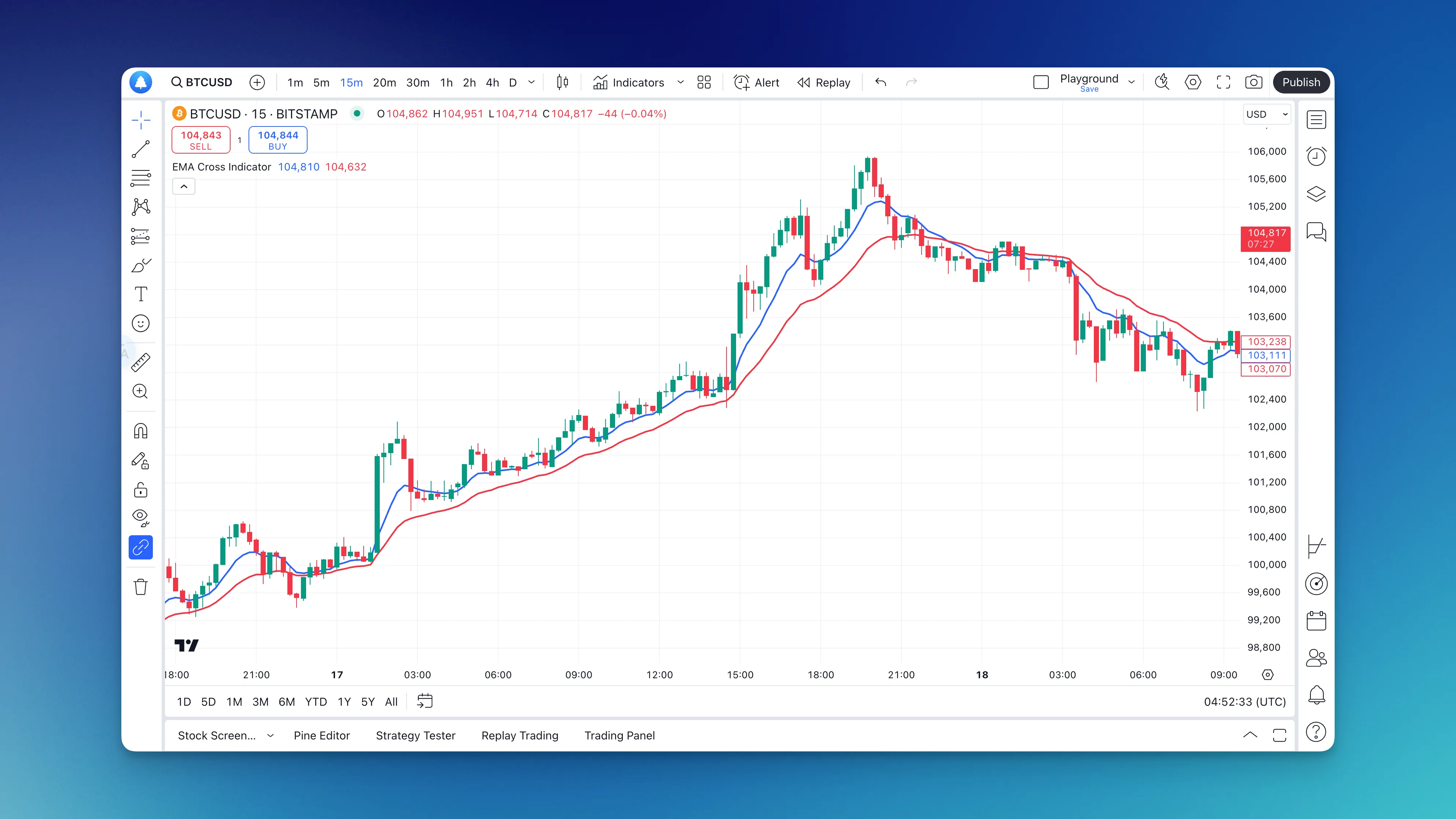

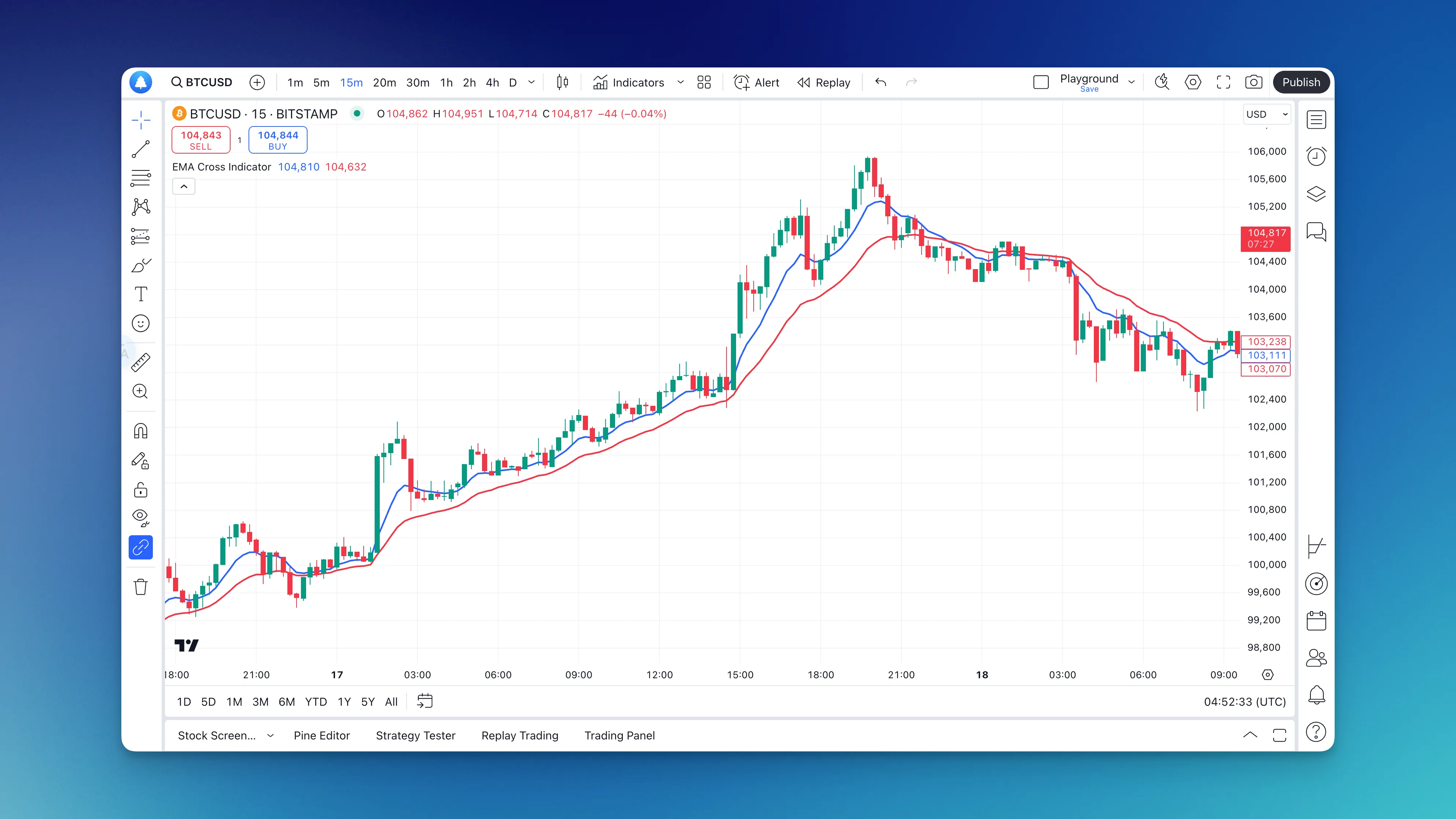

How to Code EMA Crossover Pine Script for Trading Wins

The Exponential Moving Average Cross (pine script price above ema) Indicator is a powerful tool used in trading to identify potential buy and sell signals based on the crossover of two EMAs. This article will introduce Pineify—a no-code tool for creating custom indicators—and guide you through adding the EMA Cross Indicator using Pineify, optimal settings, and practical trading strategies.

What is EMA Cross Indicator?

The EMA Cross Indicator utilizes two EMAs calculated over different periods to generate trading signals. The fundamental principle behind this indicator is that when a shorter-term EMA crosses above a longer-term EMA, it typically signals a bullish trend, indicating a potential buying opportunity. Conversely, when the shorter-term EMA crosses below the longer-term EMA, it suggests a bearish trend, signaling a potential selling opportunity.

Key Features of the EMA Cross Indicator

- Trend Identification: Helps traders identify potential trend reversals and continuation patterns.

- Signal Generation: Provides clear buy and sell signals based on crossovers.

- Noise Reduction: Smoother than simple moving averages, EMAs reduce market noise and help clarify trends.

Common EMA Settings

- Short-Term EMA: Often set to 9 or 10 periods for quick responsiveness.

- Long-Term EMA: Commonly set to 20 or 50 periods to capture broader market trends.

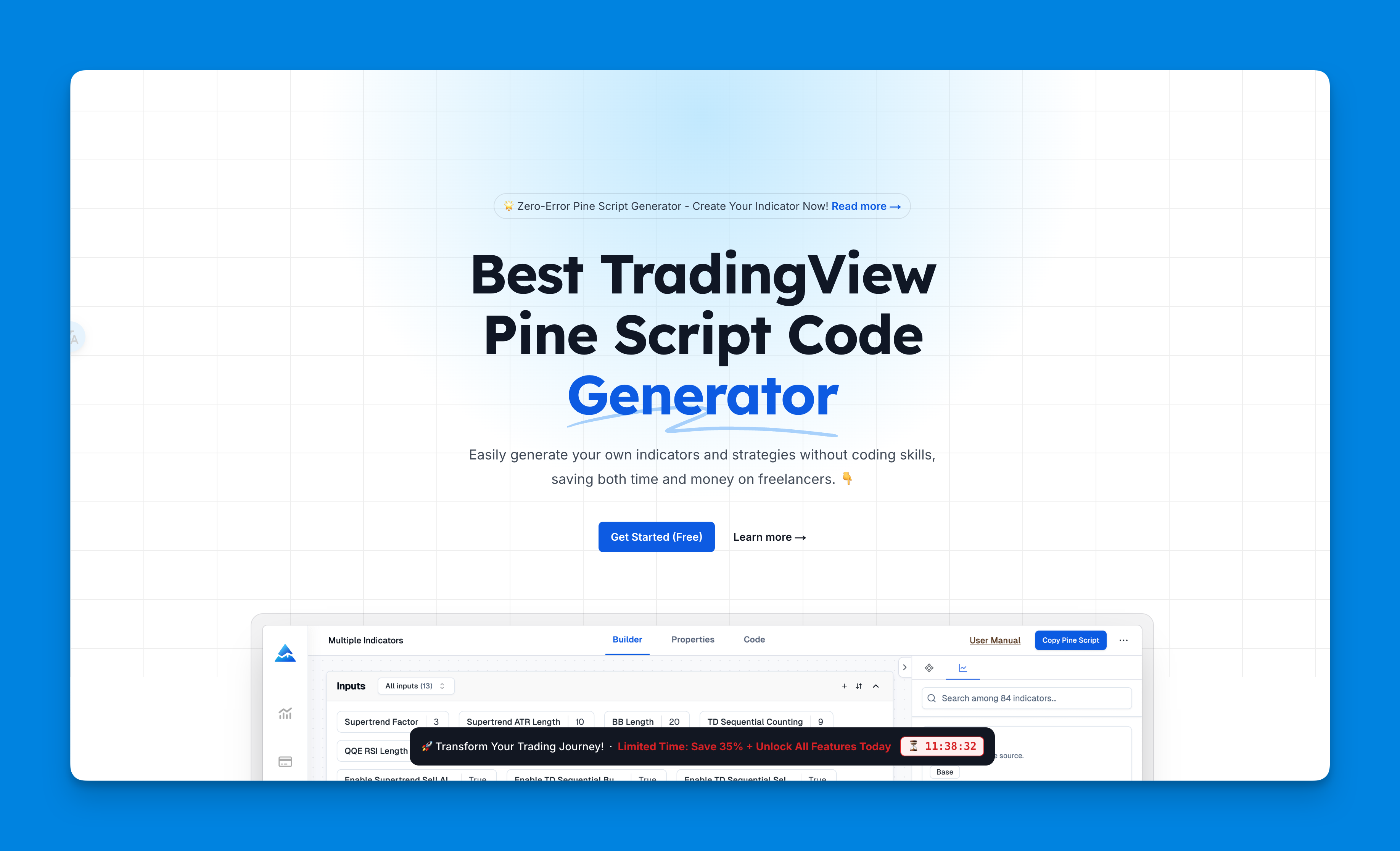

What is Pineify?

Pineify is an innovative tool designed for traders using TradingView. It allows users to create and manage trading indicators and strategies without requiring any programming skills. With Pineify, traders can focus on their market analysis rather than coding, making it accessible for both novice and experienced traders.

Key Features of Pineify

- No Coding Required: Create custom indicators visually without programming knowledge.

- Unlimited Indicators: Add as many technical indicators as needed to your charts, bypassing TradingView's limitations.

- Powerful Condition Editor: Combine multiple indicators and price data to create precise trading rules.

- Backtesting Capabilities: Test any generated indicator or strategy against historical data.

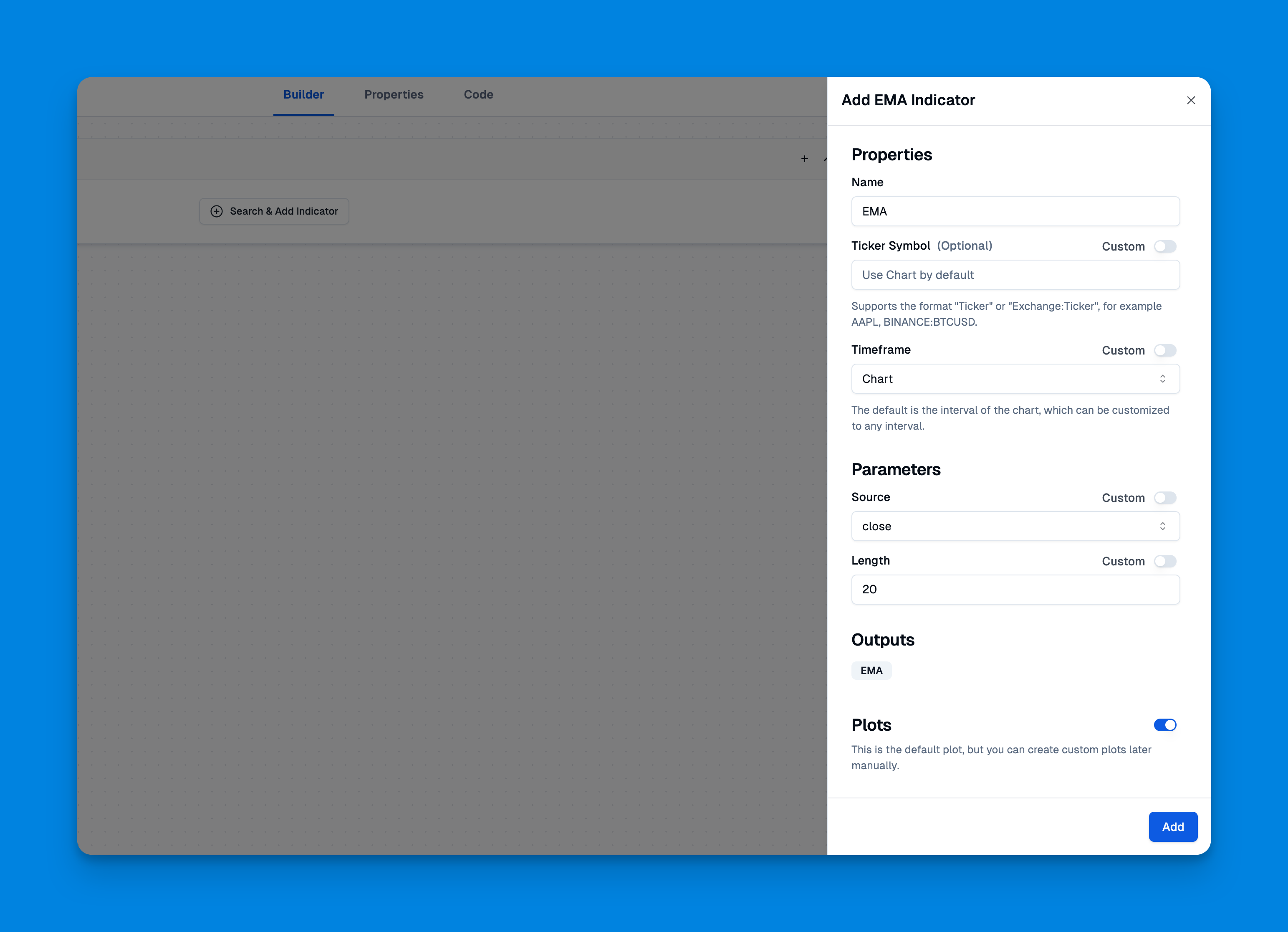

Add EMA Cross Indicator using Pineify

Integrating the EMA Cross Indicator into your TradingView charts using Pineify is straightforward. Follow these steps:

- Access Pineify:

- Visit the Pineify website and log in or create an account if you haven’t already.

- Create a New Indicator:

- Click on the "Create" button on the homepage.

- Select “Indicator” from the options presented.

- Define Your EMAs:

- Use the built-in features to define two EMAs:

- Short EMA (e.g., 9-period)

- Long EMA (e.g., 21-period)

- Set parameters for each EMA, such as color and line style for easy differentiation on your chart.

- Use the built-in features to define two EMAs:

- Copy Code to TradingView:

- Once your indicator is configured, copy the generated Pine Script code from Pineify.

- Open TradingView’s Pine Script editor and paste your code.

- Save and add your new indicator to your chart.

Click here to view all the features of Pineify.

Best EMA Cross Indicator Settings

Choosing the right settings for your EMA Cross Indicator can significantly impact its effectiveness. Here are some recommended settings based on various trading styles:

- Day Traders:

- Short EMA: 9

- Long EMA: 21

- This combination captures short-term trends effectively.

- Swing Traders:

- Short EMA: 10

- Long EMA: 50

- This setup helps identify medium-term trends while filtering out noise.

- Long-Term Investors:

- Short EMA: 20

- Long EMA: 200

- This combination helps in recognizing long-term trends and potential reversals.

Additional Tips

- Always backtest different settings against historical data to find what works best for your specific trading strategy.

- Combine the EMA crossover with other indicators (like RSI or MACD) for enhanced confirmation of signals.

How to Use EMA Cross Indicator in Trading

Using the EMA Cross Indicator effectively requires understanding its signals and implementing sound trading strategies. Here’s how you can do it:

- Set Up Your Chart:

- Add your EMAs using the settings defined earlier.

- Ensure that you have other relevant indicators if needed (e.g., RSI for confirmation).

- Identify Signals:

- Look for crossover points:

- A bullish signal occurs when the short-term EMA crosses above the long-term EMA.

- A bearish signal occurs when it crosses below.

- Look for crossover points:

- Confirm with Additional Indicators:

- Use additional tools like RSI or MACD to confirm trade entries:

- For example, enter a buy position only if RSI indicates an oversold condition alongside a bullish crossover.

- Use additional tools like RSI or MACD to confirm trade entries:

- Manage Risk:

- Always implement stop-loss orders to protect your capital:

- Place stop-loss orders just below recent swing lows for long positions or above recent swing highs for short positions.

- Always implement stop-loss orders to protect your capital:

- Monitor Trades:

- Keep an eye on market conditions as they can change rapidly:

- Be prepared to exit trades if market conditions shift against your position or if opposing signals arise.

- Keep an eye on market conditions as they can change rapidly:

Conclusion

The EMA Cross Indicator is an essential tool for traders looking to capitalize on market trends through effective signal generation. With Pineify's user-friendly interface, creating and managing this indicator has never been easier. By following best practices in setting up your indicators and employing sound trading strategies, you can enhance your trading performance significantly.

Ready to take control of your trading? Start using Pineify today to create custom indicators that align with your unique trading style! Whether you're a beginner or an experienced trader, leveraging tools like Pineify can streamline your strategy development process and improve your market analysis capabilities.