Pine Script Supertrend: A Guide to Trend-Following Strategies

The Supertrend indicator is a popular tool among traders for identifying market trends and potential entry and exit points.

This article delves into the intricacies of the Pine Script Supertrend, providing a detailed overview, practical applications, and tips for implementation. By the end, you will have a solid understanding of how to leverage this powerful trading strategy effectively.

What is Supertrend?

The Supertrend is a trend-following indicator that utilizes the Average True Range (ATR) to determine the direction of the market. It helps traders identify whether to go long or short based on price movements relative to the Supertrend line. When the price is above the Supertrend line, it indicates an uptrend; conversely, when it's below, it signals a downtrend.

Key Features of Supertrend

- Trend Direction: Provides clear signals for uptrends and downtrends.

- Volatility Measurement: The ATR component allows traders to assess market volatility, enhancing decision-making.

- Customizable Parameters: Traders can adjust settings like ATR length and multiplier to suit their trading style.

Implementing Supertrend in Pine Script

To implement the Supertrend indicator in Pine Script, follow this basic structure:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Supertrend", overlay = true, timeframe = "", timeframe_gaps = true)

atrPeriod = input.int(10, "ATR Length", minval = 1)

factor = input.float(3.0, "Factor", minval = 0.01, step = 0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

supertrend := barstate.isfirst ? na : supertrend

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style = plot.style_linebr)

downTrend = plot(direction < 0 ? na : supertrend, "Down Trend", color = color.red, style = plot.style_linebr)

bodyMiddle = plot(barstate.isfirst ? na : (open + close) / 2, "Body Middle",display = display.none)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps = false)

alertcondition(direction[1] > direction, title='Downtrend to Uptrend', message='The Supertrend value switched from Downtrend to Uptrend ')

alertcondition(direction[1] < direction, title='Uptrend to Downtrend', message='The Supertrend value switched from Uptrend to Downtrend')

alertcondition(direction[1] != direction, title='Trend Change', message='The Supertrend value switched from Uptrend to Downtrend or vice versa')

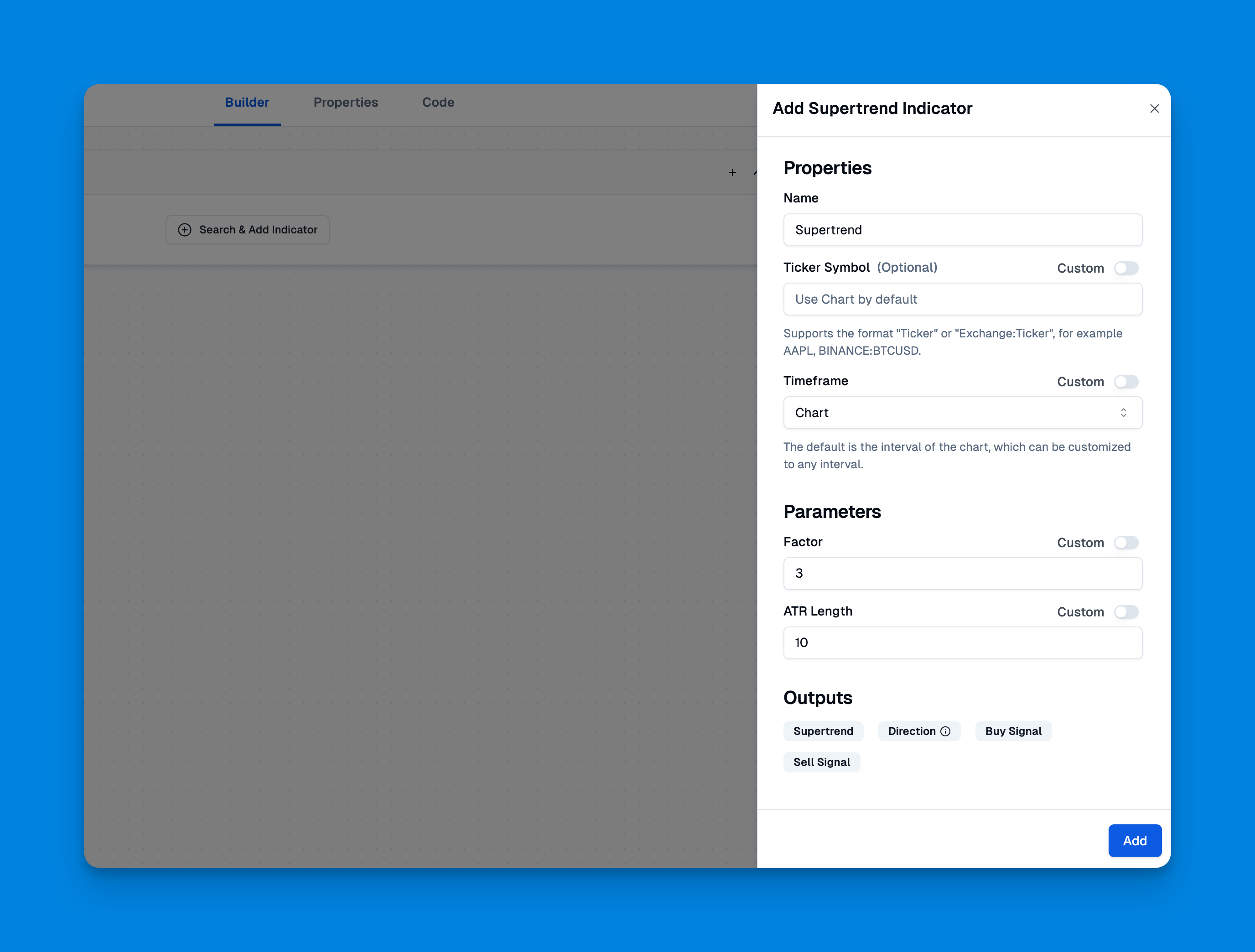

Add Supertrend Indicator On Pineify Without Coding

Website: Pineify

To add the Supertrend Indicator on Pineify, users can leverage the platform's intuitive interface that allows for the creation and management of custom indicators without any programming skills.

Pineify simplifies the process by enabling traders to bypass TradingView's default limitations, allowing them to add unlimited technical indicators to their charts. This feature is particularly beneficial for those looking to incorporate the Supertrend Indicator alongside other analytical tools.

Click here to view all the features of Pineify.Strategies Using Supertrend

The Supertrend indicator can be used in various trading strategies:

- Basic Trend Following:

- Buy when the price crosses above the upper band.

- Sell when the price crosses below the lower band.

- Combining with Other Indicators:

- Use with RSI or MACD for confirmation signals.

- Implement stop-loss and take-profit levels based on volatility measures.

Backtesting Strategies

Before deploying any strategy live, backtesting is crucial. TradingView provides tools to backtest your Pine Script strategies effectively:

- Set Up Historical Data: Ensure your script runs on historical data.

- Analyze Results: Look at metrics like win rate, drawdown, and profit factor.

- Optimize Parameters: Adjust your ATR length and multiplier based on backtesting results for better performance.

Common Pitfalls and How to Avoid Them

- Overfitting: Avoid customizing parameters excessively based on historical data as this can lead to poor performance in live trading.

- Ignoring Market Conditions: Understand that different market conditions may require different strategies.

Conclusion

The Pine Script Supertrend indicator, available through Pineify's comprehensive platform, is a versatile tool that can significantly enhance your trading strategy. By understanding its mechanics and implementing it correctly within your trading framework using Pineify's user-friendly interface, you can improve your decision-making process and potentially increase profitability.

References

- https://www.pineconnector.com/blogs/pineconnector-script-library/supertrend-strategy

- https://www.youtube.com/watch?v=4BhsjF2GKAA

- https://www.youtube.com/watch?v=jyLe3USVVsc

- https://www.youtube.com/watch?v=YMCatRlEux8

- https://docs.pineconnector.com/supertrend-strategy

- https://stackoverflow.com/questions/75867414/tradingview-pine-script-take-profit-supertrend

- https://docs.algotest.in/signals/pinescripts/supertrend_strategy/

- https://github.com/rahulmr/Pinescript-SuperTrend-Trading-Strategy

- https://gist.github.com/marketcalls/01565ccb07d1373ef92e

- https://pineify.app/resources/blog/multi-timeframe-supertrend-indicator-for-tradingview-pine-script

- https://in.tradingview.com/scripts/supertrend/