Mastering ADX with Pine Script: A Detailed Guide

The Average Directional Index (ADX) is a powerful tool in technical analysis, widely used by traders to gauge the strength of a trend. When combined with Pine Script, particularly the ta.dmi() function, traders can create custom indicators and strategies on platforms like TradingView. This article delves into the intricacies of the ADX, its components, and how to effectively implement it using Pine Script.

What is ADX?

The Average Directional Index (ADX) was developed by J. Welles Wilder in 1978. It quantifies the strength of a trend without indicating its direction. The ADX is derived from two other indicators:

- +DI (Positive Directional Indicator): Measures upward price movement.

- DI (Negative Directional Indicator): Measures downward price movement.

The ADX itself ranges from 0 to 100, with higher values indicating stronger trends:

- 0-25: Weak trend

- 25-50: Strong trend

- 50-75: Very strong trend

- 75-100: Extremely strong trend

Components of the DMI

The Directional Movement Index (DMI) consists of three key components:

- +DI: Indicates the strength of upward price movement.

- DI: Indicates the strength of downward price movement.

- ADX: Reflects the overall strength of the trend.

Using ta.dmi() in Pine Script

The ta.dmi() function simplifies the calculation of these components in Pine Script. The syntax for this function is as follows:

ta.dmi(diLength, adxSmoothing) → [series float, series float, series float]

Arguments

- diLength: The period for calculating +DI and -DI values.

- adxSmoothing: The smoothing period for the ADX calculation.

Returns

The function returns a tuple containing three series:

+DIDIADX

Example Implementation in Pine Script

Here’s a basic example of how to implement the DMI using Pine Script:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator(title="[Pineify - Best Pine Script Generator] - Directional Movement Index", shorttitle="DMI", format=format.price, precision=4, overlay = false)

len = input.int(14, minval=1, title="DI Length")

lensig = input.int(14, title="ADX Smoothing", minval=1, maxval=50)

[diplus, diminus, adx] = ta.dmi(len, lensig)

plot(adx, color=color.red, title="ADX")

plot(diplus, color=color.blue, title="+DI")

plot(diminus, color=color.orange, title="-DI")

This script creates a DMI indicator that plots +DI, -DI, and ADX on a TradingView chart.

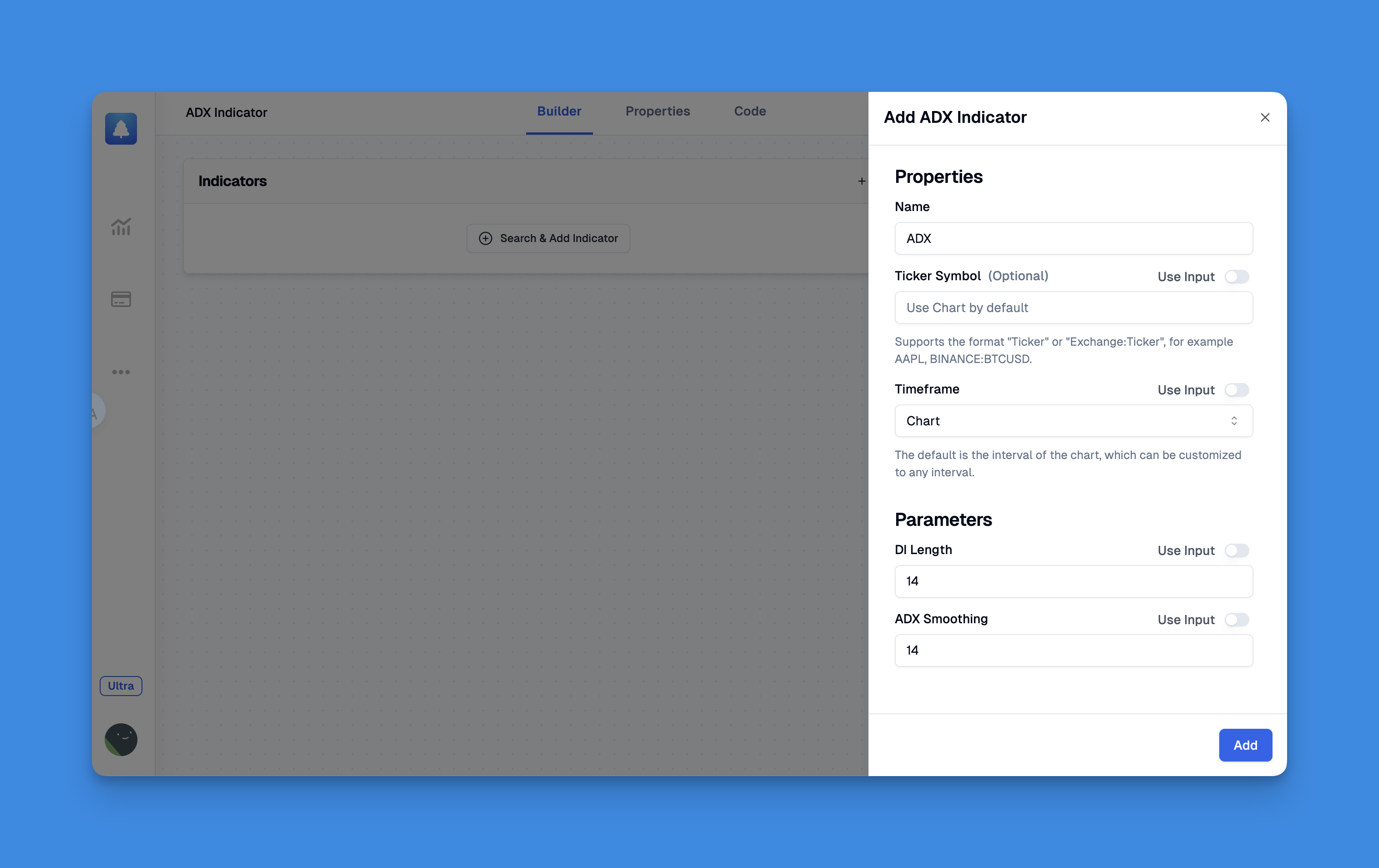

Generate ADX Indicator with Pineify

Website: Pineify

Integrating the Average Directional Index (ADX) indicator into your trading arsenal has never been easier, thanks to Pineify. This revolutionary tool allows traders, regardless of their programming skills, to quickly generate custom indicators and strategies for TradingView. Pineify eliminates the hassle associated with traditional coding by providing a user-friendly interface that lets you seamlessly create the ADX indicator along with unlimited other technical indicators on your charts.

With its powerful condition editor, Pineify enables you to combine the ADX with different price data and multiple indicators to refine your trading rules precisely. Whether you're looking to track market trends or make informed trading decisions, Pineify’s customization options allow for flexibility in defining inputs and conditions for the ADX. Plus, you can backtest your strategies effectively and manage risk using take-profit and stop-loss orders, all without any coding required.

Pineify not only saves you time and money but also enhances your trading efficiency by allowing the integration of vast analytical capabilities in one platform. So, if you aim to master the ADX indicator and elevate your trading game, give Pineify a try and transform how you analyze market movements.

Click here to view all the features of Pineify.Trading Strategies Using ADX

Traders often use crossovers between +DI and -DI as signals for potential trades:

- Buy Signal: When +DI crosses above -DI.

- Sell Signal: When -DI crosses above +DI.

Additionally, incorporating ADX readings can help filter trades:

- Enter long positions when ADX is above 25 (indicating a strong trend).

- Consider exiting or avoiding trades when ADX falls below 20.

Advanced Strategies with DMI and Other Indicators

Combining DMI with other indicators can enhance trading strategies. For example:

- DMI and RSI: Use RSI to confirm overbought or oversold conditions while using DMI for trend strength.

- DMI with Moving Averages: Use moving averages to determine overall market direction while using DMI for entry points.

Limitations of DMI

While useful, the DMI has limitations:

- It can produce false signals during choppy market conditions.

- The crossover signals may not always lead to significant price movements.

Conclusion

The ADX and its components (+DI and -DI) are essential tools for traders looking to assess market trends effectively. By utilizing Pine Script's ta.dmi() function, traders can create customized indicators and strategies tailored to their trading style.

References:

- https://docs.algotest.in/signals/pinescripts/adx_strategy/

- https://pineify.app/resources/blog/pine-script-tadmi-a-comprehensive-guide

- https://www.youtube.com/watch?v=kqsi5XDqR1M

- https://www.youtube.com/watch?v=i6pvoXo_XyI

- https://stackoverflow.com/questions/75828537/i-want-to-make-a-pinescript-v5-strategy-with-adx-and-rsi-but-keep-receiving-the/75828581

- https://github.com/yaoyao-wang/dmi_and_adx

- https://www.tradingview.com/scripts/averagedirectionalindex/

- https://www.youtube.com/watch?v=Xde-JGbDeAo

- https://www.investopedia.com/terms/d/dmi.asp

- https://www.tradingview.com/scripts/directionalmovement/