How to Avoid Repainting in Pine Script

Repainting is a common issue in Pine Script that can lead to inaccurate backtesting results and unreliable trading signals. This article will guide you through understanding repainting, its causes, and effective strategies to avoid it while coding in Pine Script.

Understanding Repainting

Repainting occurs when an indicator or script provides different signals on historical data compared to real-time data. This can mislead traders, especially during backtesting, as the results may appear more favorable than they truly are.

Key Points:

-

What Causes Repainting?

Repainting typically happens when scripts reference higher timeframe data or use real-time values that change before the bar closes.

-

Why Is It Problematic?

It can result in false signals, leading traders to make decisions based on inaccurate information.

Common Types of Repainting

-

Indicator Repainting:

Indicators that update their values based on real-time data can change their past values, causing discrepancies between historical and live signals.

-

Strategy Repainting:

Strategies that rely on real-time bar states may provide different results when tested historically versus live.

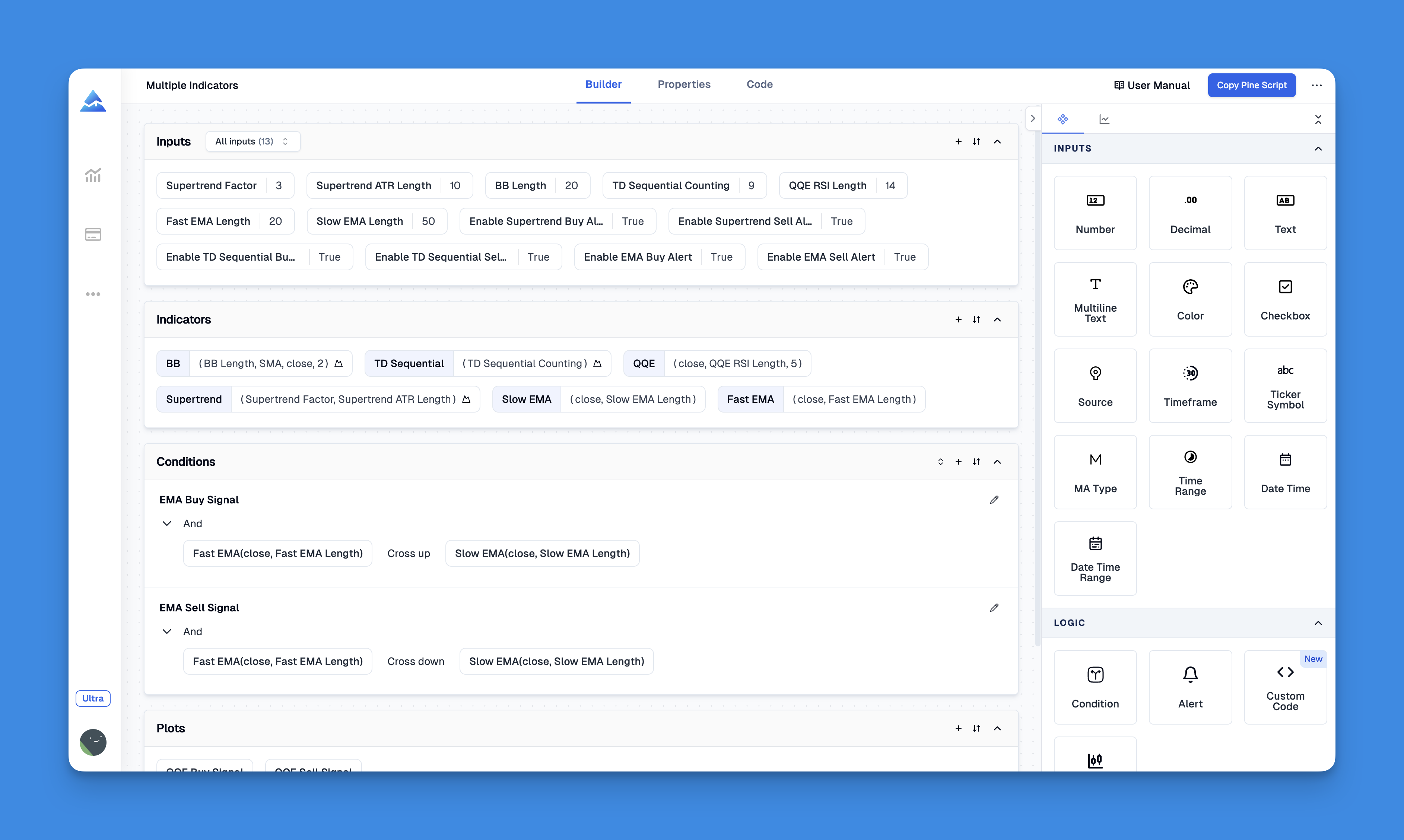

Ensuring Non-Repainting Strategies with Pineify

Repainting occurs when indicator signals change based on future price data, creating misleading results that can impact trading decisions. Using reliable tools with consistent metrics is essential to avoid this issue.

Website: Pineify

Click here to view all the features of Pineify.Pineify enables traders to build custom, non-repainting indicators without coding knowledge. Its condition editor helps create precise trading rules that maintain accuracy.

With Pineify, traders can trust their signals will remain consistent, supporting the development of reliable strategies suited to their trading approach.

How to Avoid Repainting

To prevent repainting in your Pine Script indicators and strategies, follow these best practices:

1. Use request.security() Wisely

When fetching data from higher timeframes, use the request.security() function correctly to avoid accessing unconfirmed bars. Here's how to implement it:

//@version=5

indicator("Non-Repainting Example", overlay=true)

// Function to avoid repainting

f_security(_sym, _res, _src) =>

request.security(_sym, _res, _src[barstate.isconfirmed ? 0 : 1])

// Example usage

highValue = f_security(syminfo.tickerid, "D", high)

plot(highValue, color=color.red)

This function checks if the current bar is confirmed before accessing its value, thus avoiding real-time fluctuations.

2. Utilize Bar State Variables

Pine Script provides several built-in bar state variables that help manage repainting:

barstate.isconfirmed: Indicates if a bar is confirmed (closed).barstate.isrealtime: Indicates if the current bar is still forming.

Using these variables can help ensure that your script only processes confirmed data:

if barstate.isconfirmed

// Execute logic for confirmed bars only

3. Avoid Using Real-Time Values

Avoid using real-time values for calculations that will affect historical data. Instead, reference previous bars' values:

previousClose = close[1] // Reference the previous close instead of the current one

This ensures that your calculations are based on stable data rather than fluctuating real-time values.

4. Implement Alerts Carefully

When setting alerts in your scripts, ensure they trigger only once per bar close to avoid multiple signals during a single bar's formation:

if barstate.isconfirmed and crossover(shortMA, longMA)

alert("Buy Signal", alert.freq_once_per_bar_close)

Best Practices for Writing Non-Repainting Scripts

-

Keep Your Code Organized:

Structure your scripts clearly with comments explaining each section. This aids readability and maintenance.

-

Test Your Scripts Thoroughly:

Backtest your strategies across various timeframes and market conditions to ensure robustness against repainting issues.

-

Stay Updated with Pine Script Versions:

New versions of Pine Script may introduce features or changes that help manage repainting more effectively.

Conclusion

Avoiding repainting in Pine Script is crucial for developing reliable trading indicators and strategies. By following the guidelines outlined above—using request.security() wisely, leveraging bar state variables, avoiding real-time values, and implementing alerts carefully—you can create scripts that provide accurate signals without the pitfalls of repainting.

Additionally, we recommend using Pineify, a powerful tool that helps traders create non-repainting indicators without requiring deep coding knowledge. Pineify's user-friendly interface and built-in safeguards against repainting make it an excellent choice for both beginners and experienced traders looking to develop reliable trading strategies.