How to Master the Bollinger Band Squeeze Indicator for Higher Profit Margins

Understanding market volatility and price movements is crucial for successful trading. One of the most effective tools for this purpose is the Bollinger Bands Squeeze Indicator. This guide will delve into what the Bollinger Bands Squeeze Indicator is, how to utilize it effectively using Pineify, and the best practices for trading with this powerful indicator.

What is Bollinger Bands Squeeze Indicator?

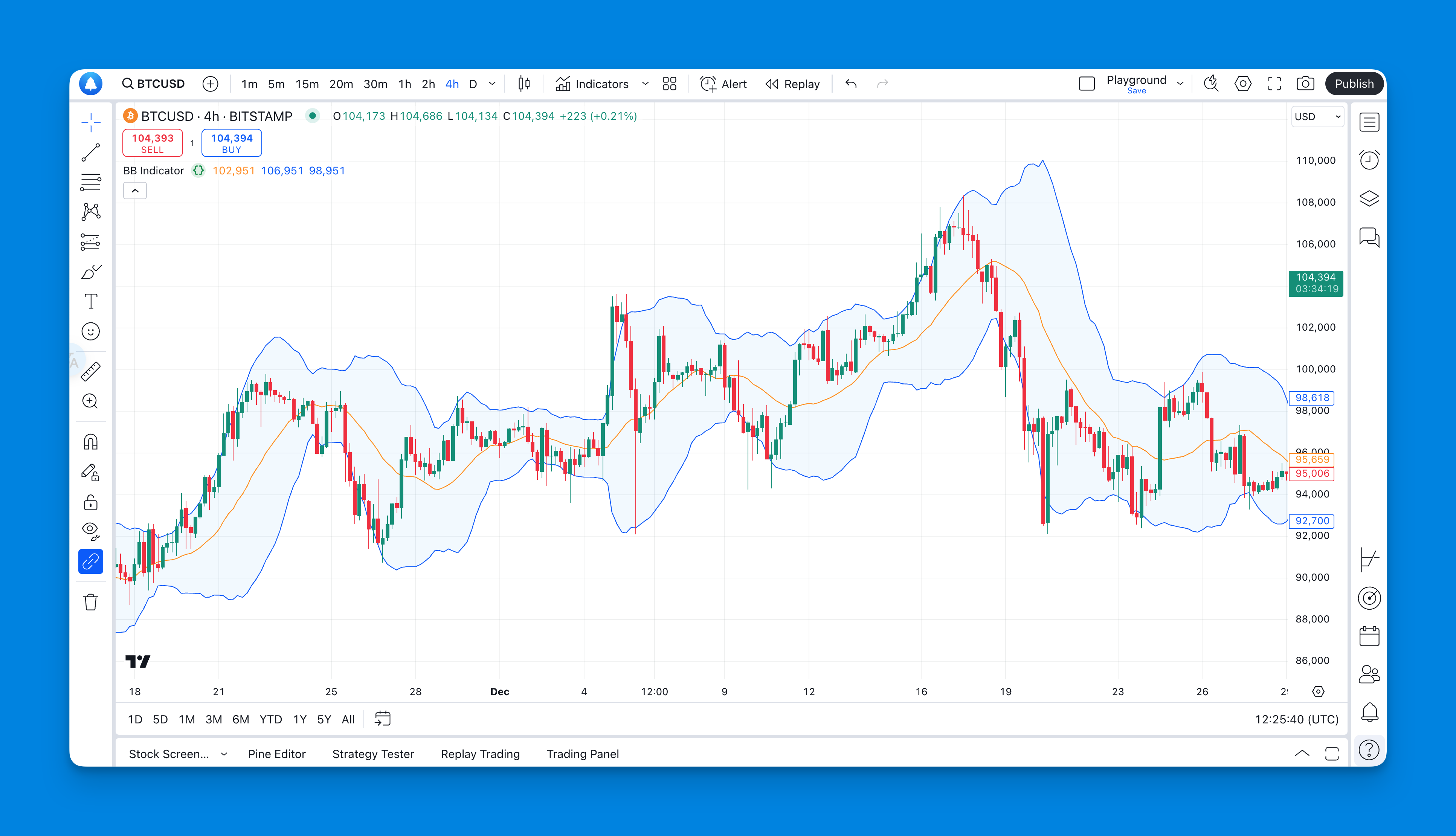

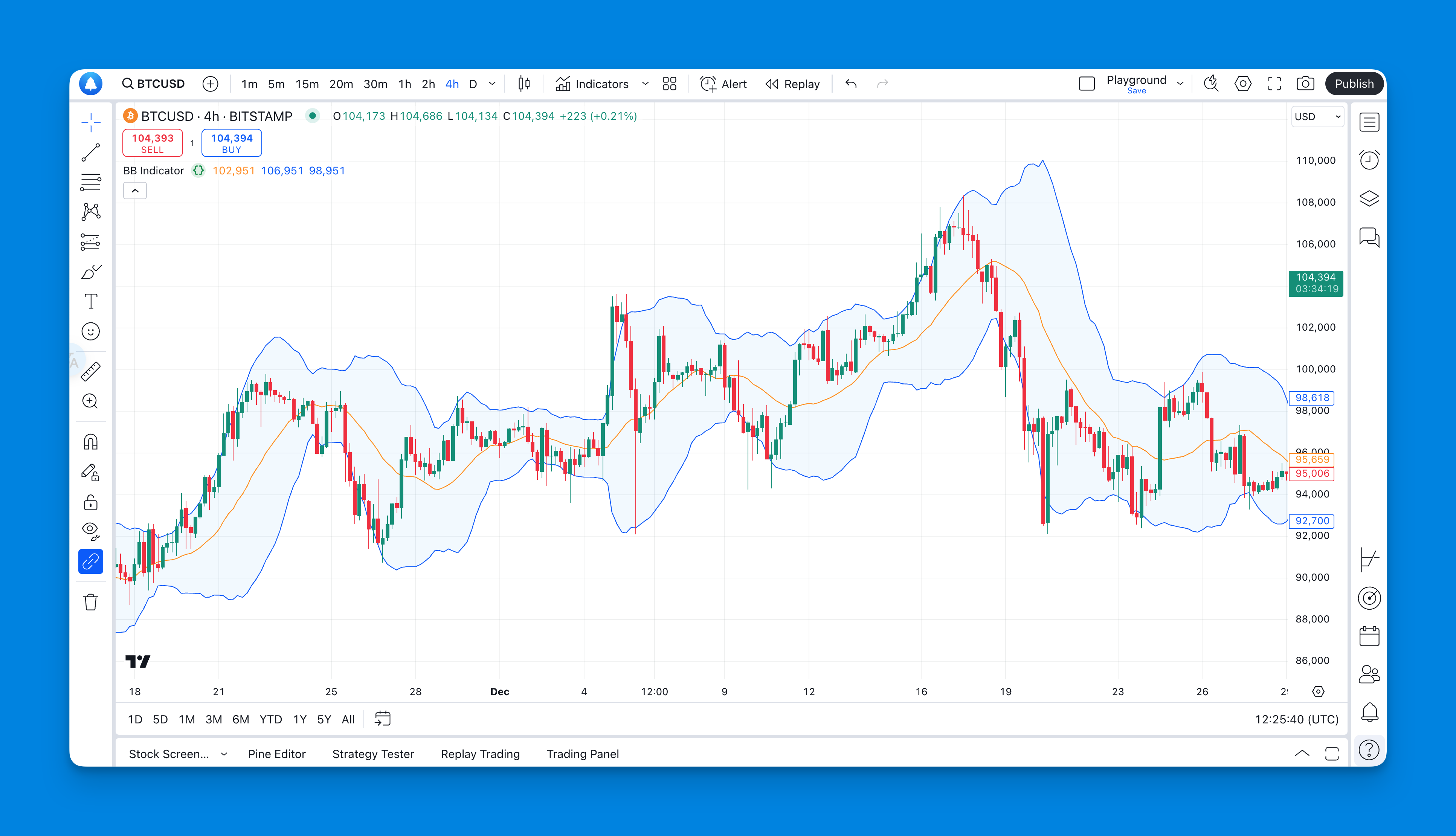

The Bollinger Bands Squeeze Indicator is a technical analysis tool developed by John Bollinger. It consists of three lines: a simple moving average (SMA) in the middle and two bands that are plotted two standard deviations away from this average. The space between these bands varies with market volatility:

- Wide Bands: Indicate high volatility, suggesting significant price movement.

- Narrow Bands: Signal low volatility, indicating a potential upcoming price breakout.

A squeeze occurs when the bands come together, reflecting a period of low volatility. Historically, this contraction is often followed by an expansion in volatility, leading to significant price movements in either direction. Traders use the squeeze as a signal to prepare for potential breakouts, making it a valuable component of their trading strategy.

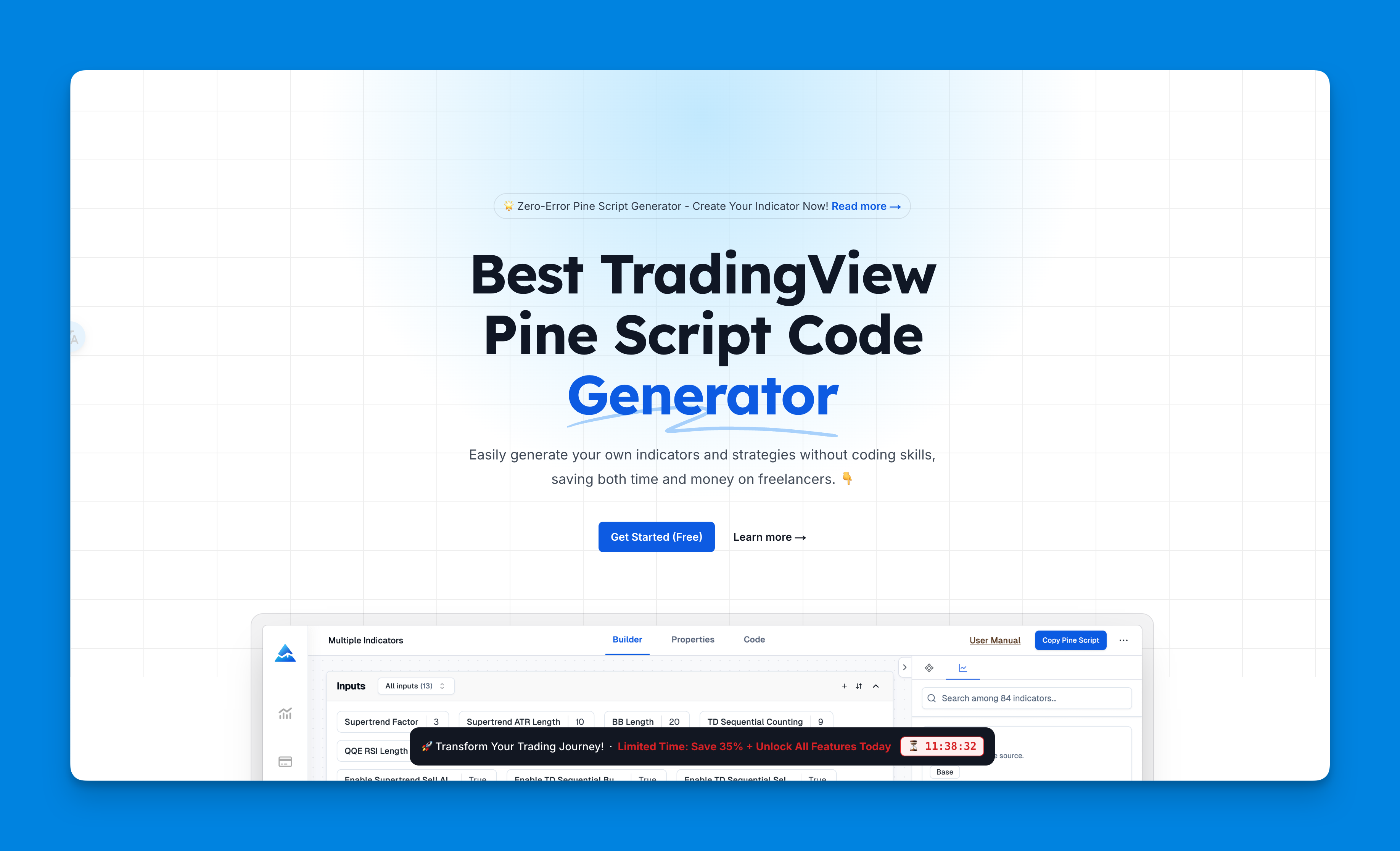

What is Pineify?

Pineify is an innovative tool designed for traders who utilize TradingView. It allows users to create and manage custom trading indicators and strategies without requiring any programming skills. Key features of Pineify include:

- Unlimited Indicators: Unlike TradingView's default limitations, Pineify enables users to add multiple indicators on a single chart.

- Customizable Inputs: Users can easily modify parameters to suit their trading strategies.

- Import Custom Code: For those with existing Pine Script indicators, Pineify allows for easy import and customization.

- User-Friendly Interface: The platform is designed to simplify the process of creating complex indicators and strategies, making it accessible for traders at all skill levels.

Add Bollinger Bands Squeeze Indicator using Pineify

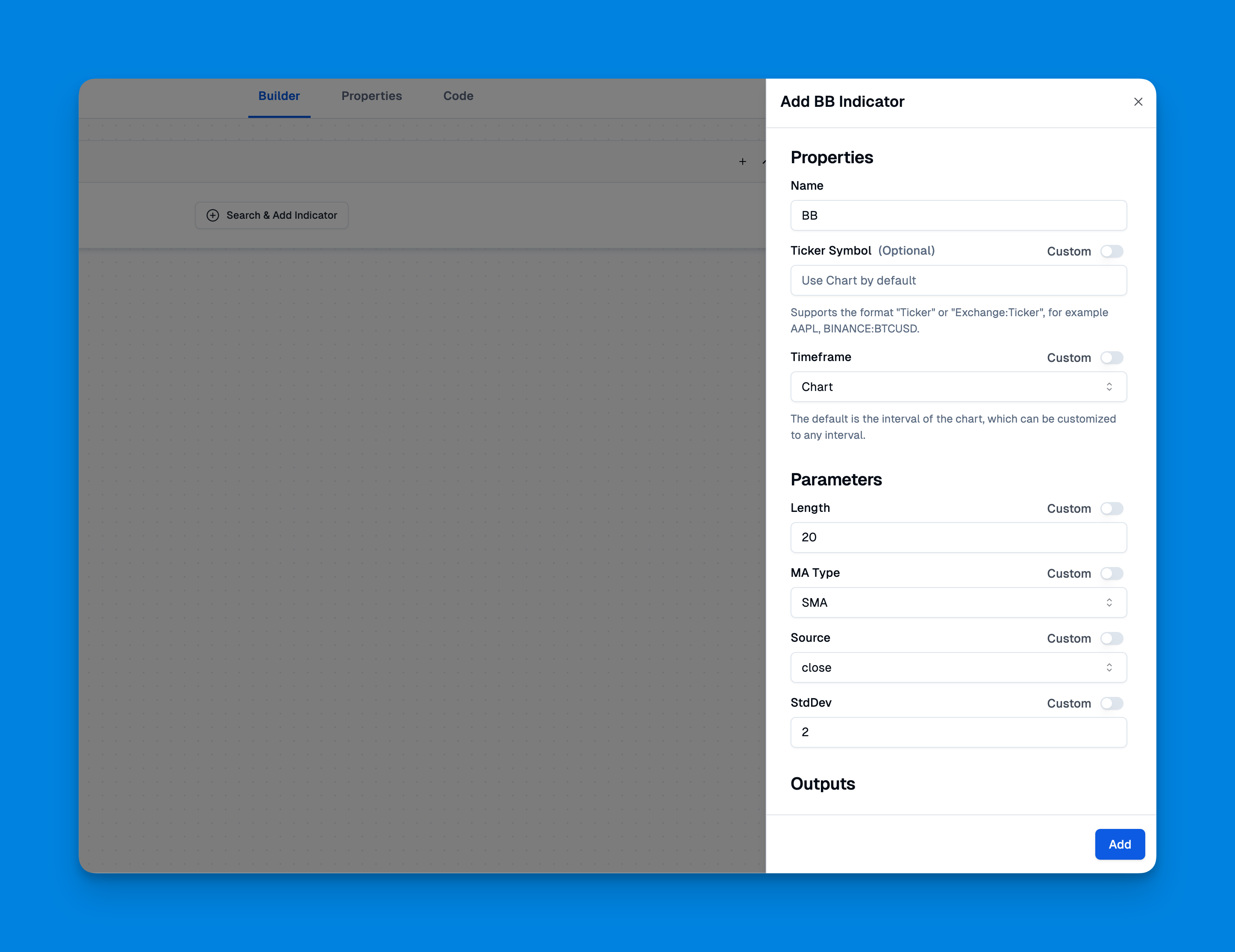

Integrating the Bollinger Bands Squeeze Indicator into your TradingView setup using Pineify is straightforward:

- Sign Up for Pineify: Create an account on Pineify’s platform.

- Access the Builder Tool: Navigate to the indicator builder section within Pineify.

- Select Bollinger Bands: Choose the Bollinger Bands from the list of available indicators.

- Customize Settings:

- Set the period (default is 20).

- Adjust standard deviation settings (commonly set at 2).

- Optionally modify other parameters based on your trading strategy.

- Add to Chart: Once configured, add the indicator to your TradingView chart to start analyzing market conditions.

Click here to view all the features of Pineify.

Best Bollinger Bands Squeeze Indicator Settings

The effectiveness of the Bollinger Bands Squeeze Indicator can be significantly influenced by its settings. Here are some recommended configurations:

- Period Length: The standard setting is 20 periods, which reflects approximately one month of trading days.

- Standard Deviation Multiplier:

- Setting at 2 captures about 95% of price action.

- For tighter bands and more frequent signals, consider adjusting to 1.5 or even 1.

- Timeframe Considerations: While it can be applied across various timeframes, many traders find success using daily or hourly charts for clearer signals.

- Combining with Other Indicators: To enhance accuracy, consider using additional indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) alongside the Bollinger Bands Squeeze.

How to Trade with Bollinger Bands Squeeze Breakout Strategy

Trading using the Bollinger Bands Squeeze involves several steps:

- Identify a Squeeze:

- Look for periods when the bands are tightly compressed.

- Confirm low volatility through historical data.

- Wait for a Breakout:

- Monitor price action closely as it approaches either band.

- A breakout above the upper band suggests a bullish trend; below the lower band indicates a bearish trend.

- Confirm with Volume:

- A significant increase in volume during a breakout strengthens the signal.

- Low volume may indicate a false breakout.

- Set Entry and Exit Points:

- Enter trades in the direction of the breakout.

- Use stop-loss orders just outside the opposite band to manage risk effectively.

- Monitor Market Conditions:

- Continuously assess market sentiment and adjust your strategy as needed.

By following these steps, traders can effectively leverage the Bollinger Bands Squeeze Indicator to capitalize on market opportunities.

Conclusion

The Bollinger Bands Squeeze Indicator is an essential tool for traders looking to navigate market volatility effectively. By understanding its mechanics and integrating it into your trading strategy using platforms like Pineify, you can enhance your ability to predict significant price movements.

Whether you're a novice trader or an experienced investor, mastering this indicator can provide you with valuable insights into market dynamics. Start experimenting with different settings and combinations today, and watch how your trading performance improves.

For those eager to elevate their trading game further, consider trying out Pineify's features today! Create custom indicators tailored to your strategies without any coding experience required—sign up now and take your trading journey to new heights!