Conditional Plotting in Pine Script: A Comprehensive Guide

Introduction

Pine Script, the scripting language for TradingView, allows users to create dynamic and interactive charts by plotting data conditionally. This feature is crucial for developing effective trading indicators that adapt to changing market conditions. In this article, we will explore how to implement conditional plotting in Pine Script, focusing on value control and color control methods.

Value Control in Conditional Plotting

Value control involves plotting na (not available) values to conditionally display data. This method is particularly useful for handling discontinuous data sets.

Example: Discontinuous Plots

Consider a script that plots values every three bars:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Discontinuous plots", "", true)

bool plotValues = bar_index % 3 == 0

plot(plotValues ? high : na, color = color.fuchsia, linewidth = 6, style = plot.style_linebr)

In this example, plotValues is a boolean that determines whether to plot the high value or na, effectively creating a discontinuous plot.

Customized Plotting After a Specific Date

To restrict plotting to bars after a specific date, you can use the input.time() function:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Conditional Plot", "", true)

startInput = input.time(timestamp("2025-03-01"))

plot(time > startInput ? close : na)

This script plots the closing price only for bars after the specified date.

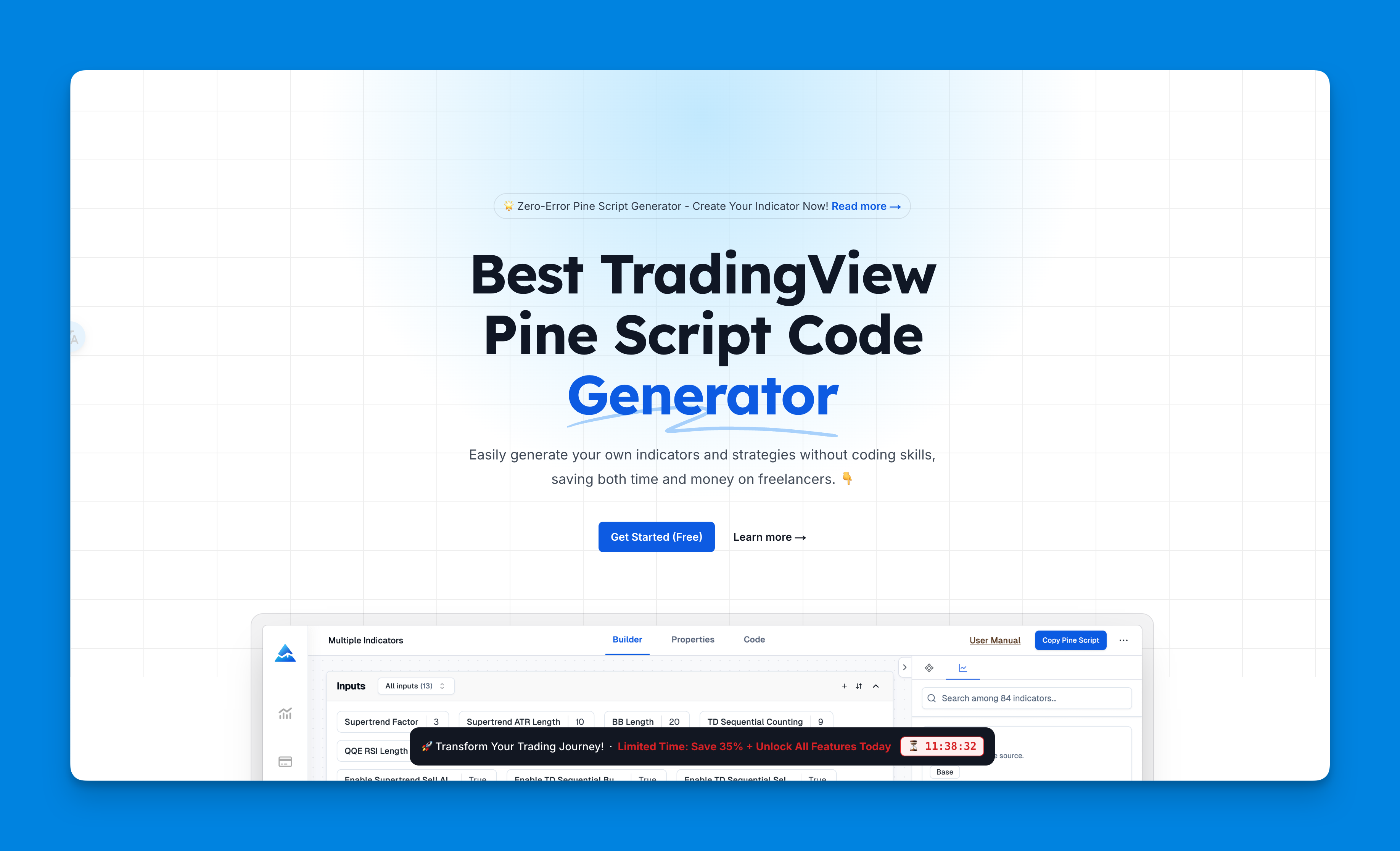

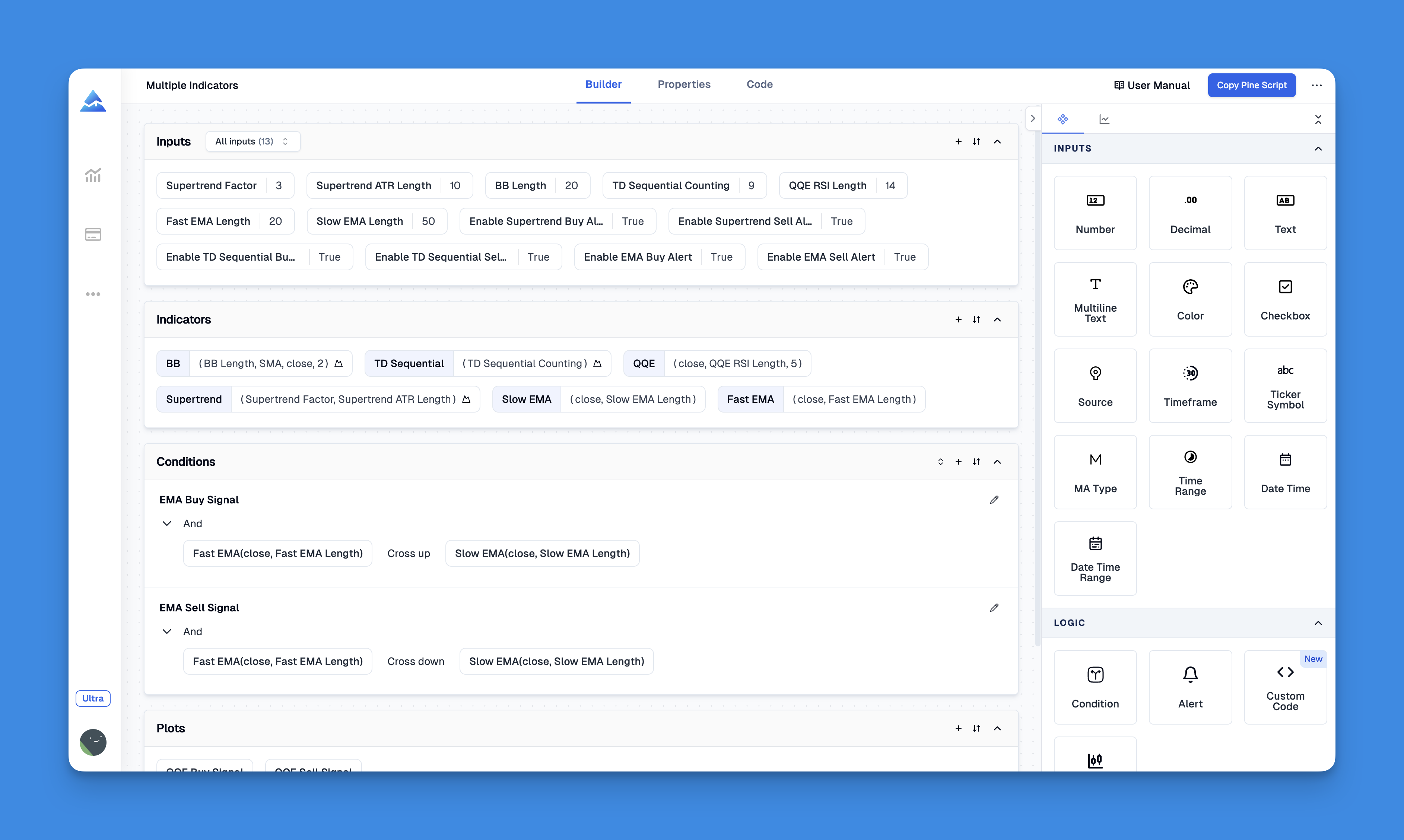

Enhancing Conditional Plotting Efficiency with Pineify’s Visual Tools

Pineify revolutionizes conditional plotting in Pine Script by eliminating coding barriers through its intuitive visual editor. Traders can dynamically combine technical indicators, price action, and market data to create complex conditional rules without writing a single line of code. For example, users might configure a crossover strategy where xxxx = ta.crossover(emaFast, emaSlow) automatically triggers specific plot styles or alert conditions through Pineify’s drag-and-drop interface.

The platform’s timeframe-aware plotting ensures conditional visuals adapt to chart resolution changes, maintaining consistency across analysis scenarios. Users report 70% faster implementation of multi-condition systems compared to manual coding, particularly when managing interrelated plots across asset classes. With Pineify’s lifetime license including future updates, traders gain a sustainable solution for evolving conditional plotting needs in volatile markets.

Website: Pineify

Click here to view all the features of Pineify.Color Control in Conditional Plotting

Color control is another powerful method for creating visually distinct and informative charts. By dynamically changing the color of plots based on conditions, you can highlight different market states.

Coloring Moving Averages Based on Direction

Here’s an example of coloring a moving average based on whether it is rising or falling:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Conditional colors", "", true)

int lengthAlter = input.int(20, "Length", minval = 2)

color maBullishColor = input.color(color.green, "Bull")

color maBearishColor = input.color(color.maroon, "Bear")

float maValue = ta.sma(close, lengthAlter)

bool maIsRising = ta.rising(maValue, 1)

color maColor = maIsRising ? maBullishColor : maBearishColor

plot(maValue, "MA", maColor, 2)

In this script, the moving average is colored green when rising and maroon when falling.

Key Takeaways

- Value Control: Use

navalues to conditionally display plots, ideal for discontinuous data. - Color Control: Dynamically change plot colors based on conditions to highlight market states.

- Conditional Plotting: Use conditions based on bar index or time to control when to plot.

Conclusion

Conditional plotting in Pine Script is a versatile tool for creating dynamic and informative trading indicators. By mastering value and color control methods, you can develop indicators that visually represent complex market conditions, enhancing your trading strategies and decision-making processes.