Unlocking the Power of Pine Script Trading Bots

In the fast-paced world of financial markets, automation has become a crucial tool for traders seeking to maximize efficiency and minimize risk. One of the most powerful tools in this arena is the Pine Script trading bot, designed specifically for TradingView. This article will delve into the world of Pine Script, exploring its benefits, how to create a trading bot, and why it’s a game-changer for traders.

What is Pine Script?

Pine Script is a specialized programming language developed by TradingView, allowing users to create custom technical indicators and automated trading strategies. It’s user-friendly, making it accessible to both beginners and experienced traders. With Pine Script, you can automate your trading activities by writing scripts that execute trades based on specific market conditions.

Benefits of Using Pine Script Trading Bots

- Increased Efficiency: Automated trading reduces the time required to execute trades, ensuring you never miss a trading opportunity.

- Consistency in Strategy Implementation: Bots follow predefined strategies without deviation, eliminating emotional bias.

- Round-the-Clock Operation: Unlike human traders, bots can operate 24/7 without fatigue, ideal for markets like cryptocurrency.

Creating Pine Script Trading Bots Without Coding Skills

Creating trading bots using Pine Script has traditionally required programming knowledge, presenting a significant barrier for many traders.

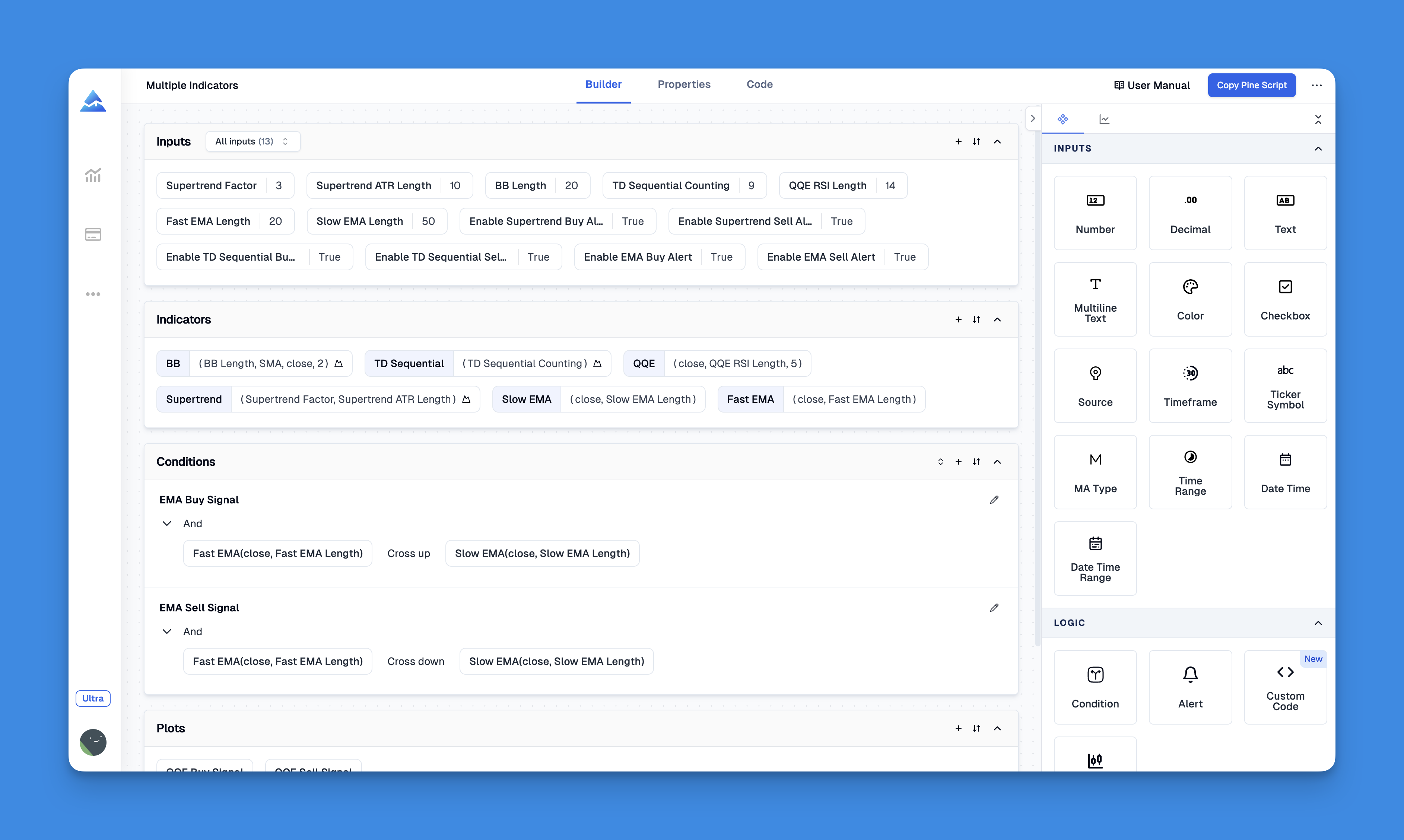

However, tools like Pineify are transforming this landscape by enabling traders to build sophisticated Pine Script indicators and strategies without writing a single line of code. This visual approach to trading bot development democratizes algorithmic trading, making it accessible to traders of all technical backgrounds while saving considerable time and resources.

Website: Pineify

Click here to view all the features of Pineify.How to Create a Pine Script Trading Bot

Creating a custom trading bot with Pine Script is straightforward:

- Set Up Your Environment: Open TradingView and navigate to the Pine Editor.

- Define Your Trading Strategy: Outline your strategy’s logic, such as buying when the RSI crosses above 30 and selling when it crosses below 60.

- Write the Script: Use Pine Script syntax to implement your strategy.

- Backtest Your Strategy: Use TradingView’s strategy tester to evaluate performance against historical data.

Advanced Features of Pine Script

- Custom Functions: Create reusable code blocks for unique strategies.

- Strategy Optimization: Optimize scripts for better performance by reducing loops and optimizing indicator calculations.

- Alerts and Automation: Use TradingView’s alert system to automate trades based on specific conditions.

Why Choose Pine Script Trading Bots?

- Flexibility: Tailor bots to fit your unique trading style.

- Integration: Seamlessly integrate with TradingView for real-time data and alerts.

- Community Support: Access a vast community of developers and traders for insights and resources.

Conclusion

Pine Script trading bots offer a powerful way to automate your trading strategies, enhancing efficiency and consistency. Whether you’re a seasoned trader or just starting out, mastering Pine Script can revolutionize your trading experience.