How to Combine Two Indicators in TradingView Pine Script

TradingView's Pine Script is a powerful tool for creating custom trading indicators and strategies. Combining two indicators in Pine Script can enhance your analysis by providing more reliable signals and reducing false positives. This article will guide you through the process of combining indicators in Pine Script, explain the benefits of this approach, and offer practical examples to implement your own scripts.

Why Combine Indicators?

Combining technical indicators can significantly improve your trading strategy by:

- Filtering False Signals: Using multiple indicators together can confirm or invalidate signals, reducing the risk of acting on false positives.

- Providing a Broader Perspective: Different indicators analyze different aspects of market conditions, such as trend direction, momentum, or volatility.

- Enhancing Timing: Aligning signals from multiple indicators can help pinpoint better entry and exit points.

- Reducing Risk: A multi-indicator approach minimizes the chances of making impulsive decisions based on a single indicator.

Step-by-Step Guide to Combining Two Indicators in Pine Script

Step 1: Open the Pine Editor

- Log in to your TradingView account.

- Open any chart and navigate to the Pine Editor tab at the bottom of the screen.

Step 2: Start with a Basic Script

Begin with a blank indicator script:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Combined Indicator", overlay=true)

Step 3: Define Your Indicators

For this example, we'll combine the Relative Strength Index (RSI) and Exponential Moving Average (EMA):

// RSI Calculation

rsiValue = ta.rsi(close, 14)

// EMA Calculation

emaValue = ta.ema(close, 50)

Step 4: Combine Logic

You can use logical conditions to combine these indicators. For instance:

- A buy signal occurs when RSI is below 30 (oversold) and the price crosses above the EMA.

- A sell signal occurs when RSI is above 70 (overbought) and the price crosses below the EMA.

buySignal = (rsiValue < 30) and (close > emaValue)

sellSignal = (rsiValue > 70) and (close < emaValue)

Step 5: Plot Signals

Visualize these signals on the chart:

plotshape(buySignal, style=shape.labelup, location=location.belowbar, color=color.green, title="Buy Signal")

plotshape(sellSignal, style=shape.labeldown, location=location.abovebar, color=color.red, title="Sell Signal")

Step 6: Add Alerts (Optional)

You can set alerts for these signals:

alertcondition(buySignal, title="Buy Alert", message="RSI & EMA Buy Signal Triggered")

alertcondition(sellSignal, title="Sell Alert", message="RSI & EMA Sell Signal Triggered")

Best Practices for Combining Indicators

-

Choose Complementary Indicators

Select indicators that serve different purposes:

- Trend-following (e.g., Moving Averages).

- Momentum-based (e.g., RSI or MACD).

- Volume-based (e.g., OBV).

-

Avoid Overcrowding

Limit your combination to two or three indicators to avoid analysis paralysis.

-

Backtest Your Strategy

Use historical data to validate your combined indicator's effectiveness before applying it in live trading.

-

Understand Indicator Logic

Learn how each indicator works to ensure they complement each other rather than duplicate information.

Example: Combining MACD and RSI

Here’s an example script that combines MACD and RSI:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] MACD & RSI Combined", overlay=false)

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// RSI Calculation

rsiValue = ta.rsi(close, 14)

// Buy/Sell Conditions

buyCondition = (macdLine > signalLine) and (rsiValue < 30)

sellCondition = (macdLine < signalLine) and (rsiValue > 70)

// Plotting Signals

plotshape(buyCondition, style=shape.triangleup, location=location.belowbar, color=color.green)

plotshape(sellCondition, style=shape.triangledown, location=location.abovebar, color=color.red)

![[Pineify - Best Pine Script Generator] MACD & RSI Combined](https://r2.pineify.app/assets/a19875df3046f4b8bd4023dd44574fc3.png)

Benefits of Combining Indicators in Pine Script

- Simplifies your chart by merging multiple tools into one indicator.

- Enhances decision-making with cross-confirmation of signals.

- Allows customization tailored to specific trading strategies.

Common Mistakes to Avoid

-

Using Correlated Indicators

Avoid combining indicators that measure similar aspects of market behavior (e.g., RSI and Stochastic Oscillator).

-

Overfitting

Be cautious not to over-optimize settings during backtesting as this might not perform well in live markets.

-

Ignoring Market Context

Indicators work differently in trending vs. ranging markets; adapt accordingly.

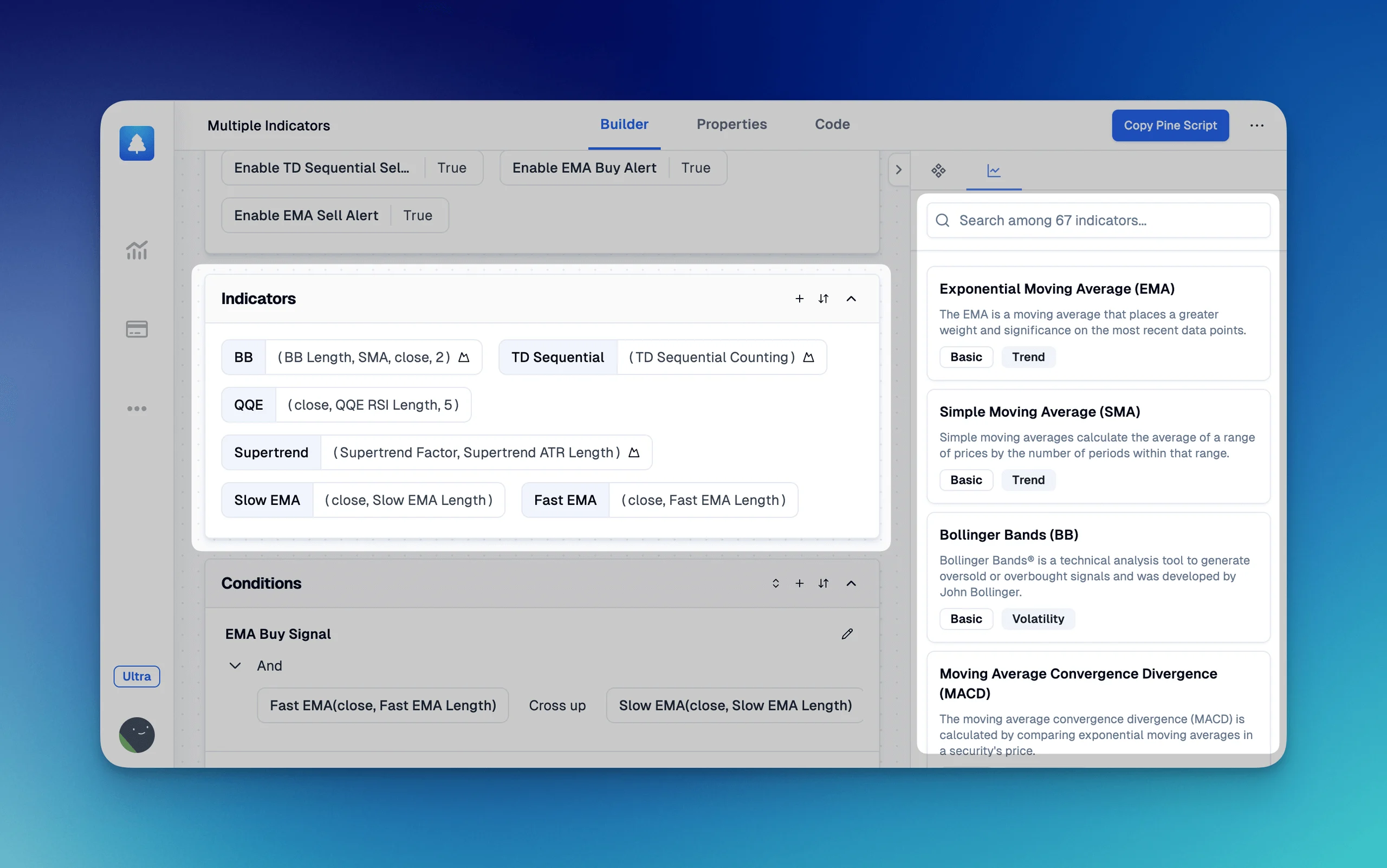

Combine Multiple Indicators with Pineify

Website: Pineify

When integrating multiple indicators into your TradingView scripts, Pineify offers an innovative and user-friendly solution to streamline the process. This AI-powered Pine Script generator eliminates the need for complex coding, allowing traders to visually combine multiple indicators into a single script easily.

With Pineify, you can bypass TradingView's default limit of two indicators per chart, enabling the addition of unlimited indicators on one chart, even with a free TradingView plan. The platform also supports customizing inputs and plots, offering flexibility for different ticker symbols and timeframes. Pineify’s powerful condition editor makes it possible to merge various technical indicators, price data, and custom rules into precise trading strategies. Whether you’re backtesting strategies or enhancing your technical analysis, Pineify is a game-changer, saving time, money, and the frustration of manual coding. Try its free plan or explore the Pro and Lifetime options for advanced features.

Click here to view all the features of Pineify.

Click here to view all the features of Pineify.

Conclusion

Combining two indicators in TradingView Pine Script is an effective way to refine your trading strategy. By leveraging complementary tools like RSI and EMA or MACD and DMI, you can filter out noise and make more informed decisions. Remember to backtest thoroughly and keep your approach simple yet effective.

References:

- https://www.tradingview.com/pine-script-docs/v4/quickstart-guide/

- https://businessday.ng/uncategorized/article/combining-technical-indicators-for-a-better-trading-strategy/

- https://www.youtube.com/watch?v=E83URba1BBA

- https://www.cryptohopper.com/blog/trading-101-combining-technical-indicators-173

- https://www.tradingwithrayner.com/course/9-how-to-combine-trading-indicators-like-a-pro/