Understanding the NA Function in Pine Script

The na() function is a fundamental built-in function in Pine Script that plays a crucial role in handling missing or undefined data points in trading indicators and strategies. If you’re working with Pine Script for technical analysis or algorithmic trading, understanding this function is essential for creating robust scripts.

What is the NA Function?

The na() function in Pine Script tests if a specific value or variable is “not a number” (na). In Pine Script terminology, ‘na’ represents an undefined or missing value in a data series. This function is particularly valuable when dealing with time series data where some points might be missing.

The syntax for the na() function is straightforward:

na(x) → simple bool

na(x) → series bool

The function accepts various data types as input (including int, float, bool, color, string, label, line, box, and linefill) and returns a Boolean value (true or false) depending on whether the input is ‘na’ or not.

Practical Applications

The na() function is especially useful in several scenarios:

- Preventing errors: When working with indicators that use past data points that might not be available

- Conditional logic: Creating logic flows that handle missing data gracefully

- Data validation: Checking if values exist before performing calculations

Here’s a simple example of how the na() function works in practice:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] NA Function Example")

// Use the `na()` function to test for `na`.

plot(na(close[1]) ? close : close[1])

In the script above, the na() function is used to check if the previous (one period ago) close price (close[1]) is na or not. If it is na, the current close price is plotted on the chart; if it is not na, the previous close price is plotted instead.

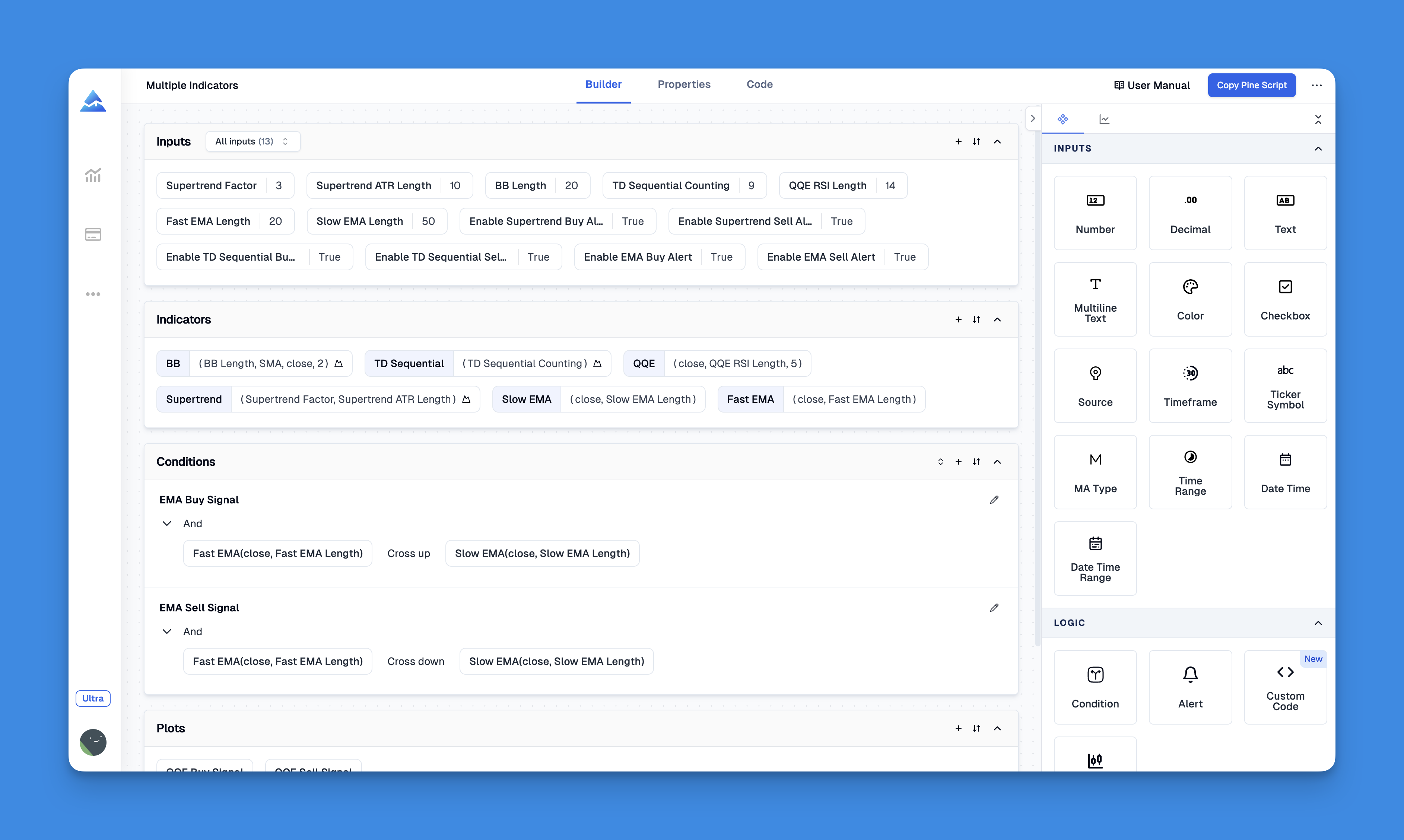

Simplifying Error Handling with NA Function in Visual Tools

The NA (Not Available) function in Pine Script is a crucial feature for managing missing data points and preventing calculation errors in trading indicators. While traditional coding requires manual NA handling, visual tools like Pineify automate this process for non-programmers.

The function acts as a placeholder for uncalculated or non-existent values, especially in indicators with lookback periods. Pineify's visual interface handles these error-handling functions automatically, ensuring indicator reliability when dealing with incomplete data.

Website: Pineify

Click here to view all the features of Pineify.NA vs. NZ Function

Pine Script also offers an alternative to the na() function called nz(). While both functions test for ‘na’ values, they behave differently:

-

na()simply returns a Boolean indicating whether a value is ‘na’ -

nz()returns the value itself if it’s not ‘na’, or a specified default value if it is ‘na’

For example:

// Using nz() to provide a default value

plot(nz(close, open))

This plots the close price if it’s available, or falls back to the open price if close is ‘na’.

Best Practices for Using NA in Pine Script

When working with the na() function in your trading scripts:

- Always check for ‘na’ values before performing calculations that might break with undefined data

- Use

nz()when you need to provide default values for missing data points - Combine with conditional statements to create robust error handling

- Test your scripts with different timeframes and instruments to ensure they handle ‘na’ values correctly

Conclusion

The na() function is a powerful tool in Pine Script that helps you create more reliable and robust trading indicators and strategies. By properly handling missing or undefined data, you can ensure your scripts work correctly across different market conditions and timeframes.