Understanding Pine Script Trailing Take Profit: A Comprehensive Guide

In the world of algorithmic trading, implementing effective exit strategies is just as crucial as crafting solid entry conditions. Trailing take profit orders represent one of the most powerful tools in a trader’s arsenal, allowing profits to grow with favorable price movements while protecting gains during market reversals. Let’s explore how to implement trailing take profit in Pine Script effectively and overcome common challenges.

What is Trailing Take Profit?

Trailing take profit is a dynamic exit strategy that adjusts your profit target as the market moves in your favor. Unlike a fixed take profit that exits at a predetermined price, a trailing take profit “trails” behind the price movement, maintaining a specific distance (or percentage) from the highest (for long positions) or lowest (for short positions) price reached since entry.

The key advantage is that it allows you to:

- Capture extended price movements during strong trends

- Lock in profits automatically if the market reverses

- Eliminate the need for constant manual adjustments

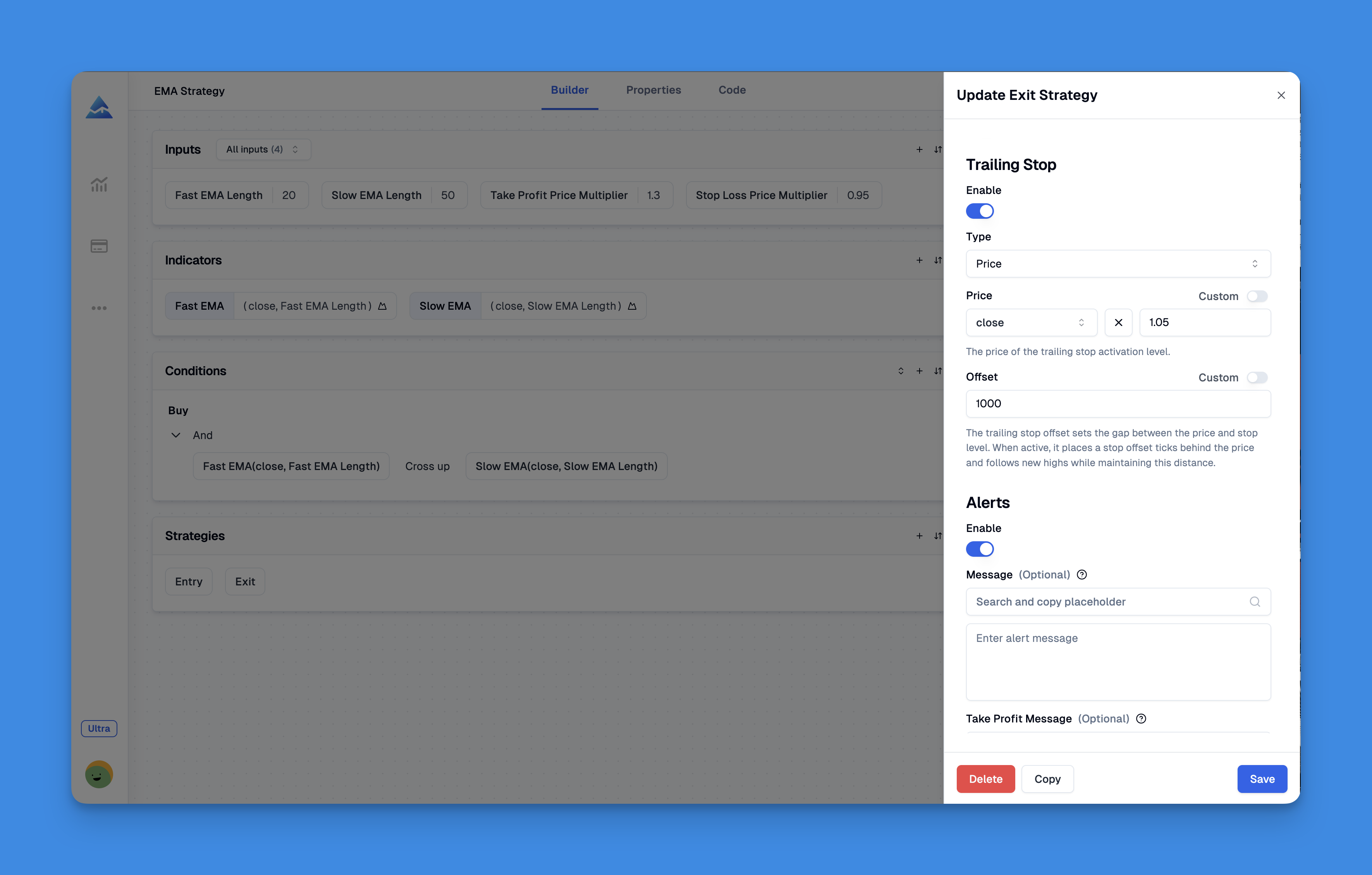

Implementing Trailing Take Profit Strategies with No-Code Solutions

In the world of algorithmic trading, trailing take profit mechanisms are essential for maximizing gains during favorable market movements, but implementing them in Pine Script traditionally requires extensive coding knowledge. This is where tools like Pineify present a revolutionary approach for traders.

Pineify allows you to create sophisticated trailing take profit strategies without writing a single line of code, making advanced trading techniques accessible to everyone regardless of programming backgroun1. Through its intuitive visual interface, you can construct complex exit conditions that dynamically adjust take profit levels based on price action or indicator signals.

Website: Pineify

Click here to view all the features of Pineify.Implementing Trailing Take Profit in Pine Script

Creating an effective trailing take profit mechanism in Pine Script requires careful consideration of several factors. Let’s break down the implementation process:

Basic Structure

//@version=5

strategy("Trailing Take Profit Example", overlay=true)

// Entry conditions

longCondition = ta.crossover(close, ta.sma(close, 20))

// Trailing take profit parameters

trailPercentage = input.float(1, "Trailing Percentage %", minval=0.1) * 0.01

activationPercentage = input.float(1.5, "Activation Percentage %", minval=0.1) * 0.01

// Entry logic

if (longCondition)

strategy.entry("Long", strategy.long)

// Calculate trailing take profit values

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

activationLevel = entryPrice * (1 + activationPercentage)

trailDistance = entryPrice * trailPercentage

// Exit logic using built-in trailing stop

strategy.exit("TP Trail", "Long", trail_points=trailDistance, trail_offset=0,

when=high >= activationLevel)

Common Challenges and Solutions

One of the most frequent issues traders face is inaccurate backtesting of trailing take profit strategies, especially when trades open and close within the same bar. This problem occurs because Pine Script processes data on a bar-by-bar basis, which can lead to unrealistic exit prices in backtests.

The Bar Magnifier Issue

Even with TradingView’s “Bar Magnifier” feature enabled in Premium accounts, many traders report inaccurate backtest results with trailing stops. The backtest often shows exits at the candle wick extreme minus the trailing offset, which doesn’t reflect real-world execution.

Solution: Using Lower Timeframes

A practical workaround is to run your strategy on a lower timeframe while calculating your indicators on the higher timeframe using request.security(). For example, if you’re trading on a 4-hour strategy, you could:

- Run the strategy on a 2-minute timeframe

- Calculate your indicators on the 4-hour timeframe using

request.security() - Execute trades only when the 4-hour conditions align

This approach allows for more granular price movement tracking within each 4-hour bar, resulting in more accurate backtest results.

Advanced Techniques for Trailing Take Profit

Dynamic Trailing Distance

Instead of using a fixed percentage, consider adjusting your trailing distance based on market volatility:

// Dynamic trailing distance based on ATR

atrPeriod = input.int(14, "ATR Period")

atrMultiplier = input.float(2, "ATR Multiplier")

dynamicTrailDistance = ta.atr(atrPeriod) * atrMultiplier

// Apply in exit logic

strategy.exit("Dynamic TP Trail", "Long", trail_points=dynamicTrailDistance,

trail_offset=0, when=high >= activationLevel)

Activation Threshold

A critical aspect of trailing take profit is determining when it should activate. Setting an appropriate activation threshold ensures you don’t exit prematurely:

- Breakeven Activation: The trailing take profit activates once the market price improves enough to place its trigger at your entry price.

- Minimum Profit Activation: If you set a minimum profit higher than 0, the trailing take profit will wait for further market price improvement to trigger at your chosen minimum profit level.

Common Mistakes to Avoid

Immediate Exit on Entry

A frequent error in Pine Script trailing take profit implementation is setting conditions that cause immediate exits after entry. This typically happens when:

- The trailing price is calculated incorrectly

- The condition for triggering the exit is always true

For example, in this code snippet, the exit condition is always true because long_trailing_price is always lower than long_previous_close_price:

long_trailing_percentage = input.float(title="Trailing %", defval=.01) * 0.01

long_previous_close_price = math.max(close, close, close)

long_trailing_price := long_previous_close_price * (1 - long_trailing_percentage)

// This condition is always true!

if long_trailing_price < long_previous_close_price

strategy.close("EL", comment="xTP", immediately = true)

Solution:

Ensure your trailing logic tracks the highest/lowest price since entry and only triggers when price reverses by your specified amount:

var float highestPrice = na

if (strategy.position_size > 0)

highestPrice := na(highestPrice) ? high : math.max(highestPrice, high)

trailPrice = highestPrice * (1 - trailPercentage)

if (close < trailPrice)

strategy.close("Long", comment="Trail TP")

Ready to Optimize Your Trading Strategy?

Implementing an effective trailing take profit mechanism in Pine Script can significantly enhance your trading results by maximizing profits during favorable trends while protecting gains during reversals. By understanding the nuances of trailing take profit implementation and avoiding common pitfalls, you can create more robust and profitable trading systems.