Unlocking the Power of Pine Script Fibonacci: A Trader's Guide

In the world of trading, understanding and leveraging technical indicators is crucial for making informed decisions. One of the most popular and effective tools in this arsenal is the Fibonacci retracement, which can be seamlessly integrated into trading strategies using Pine Script. This article delves into the world of Pine Script Fibonacci, providing insights on how to harness its potential for enhanced trading outcomes.

What is Fibonacci Retracement?

Fibonacci retracement is a technical analysis tool based on the Fibonacci sequence, which identifies levels at which price movements might reverse or pause. These levels are derived from the Fibonacci sequence, where each number is the sum of the two preceding ones (1, 1, 2, 3, 5, 8, 13, etc.). Common retracement levels include 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

Simplifying Fibonacci Analysis with No-Code Pine Script Solutions

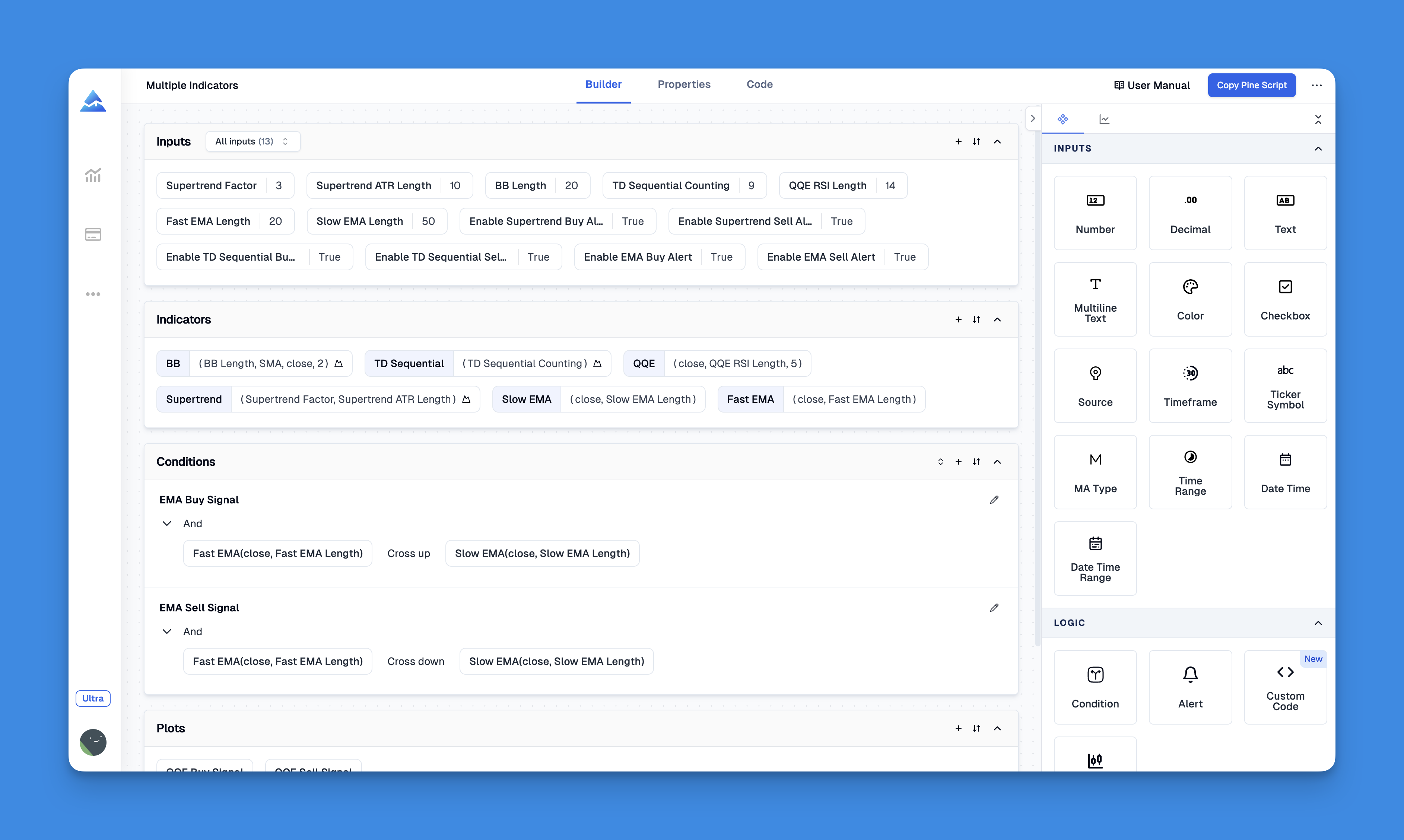

Creating Fibonacci-based indicators in Pine Script traditionally requires extensive coding knowledge, but tools like Pineify are revolutionizing this process for traders. Pineify offers a visual, no-code approach to generating sophisticated Fibonacci indicators and strategies without writing a single line of Pine Script code.

The platform's powerful condition editor allows you to construct precise trading rules based on Fibonacci retracement and extension levels. You can flexibly combine these Fibonacci indicators with other technical indicators, price data, and various market conditions to build comprehensive trading systems that align with your personal trading style. As Pineify's co-founder notes, "To profit in the market, the key is to create indicators that align with your personal trading style, rather than pursuing the 'best' indicators".

Website: Pineify

Click here to view all the features of Pineify.Implementing Fibonacci Retracement in Pine Script

Implementing Fibonacci retracement in Pine Script involves calculating the high and low of a specific period and then plotting the retracement levels. Here’s a simplified example of how to do this:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Fibonacci Retracement", overlay=true)

// Input parameters

length = input.int(20, title="Length")

showLevels = input.bool(true, title="Show Levels")

// Calculate Fibonacci levels

highPrice = ta.highest(close, length)

lowPrice = ta.lowest(close, length)

drange = highPrice - lowPrice

fib618 = highPrice - drange * 0.618

fib382 = highPrice - drange * 0.382

// Plot Fibonacci levels

plot(fib618, "61.8%", color=color.blue)

plot(fib382, "38.2%", color=color.red)

Benefits of Using Pine Script for Fibonacci Analysis

- Customization: Pine Script allows traders to customize Fibonacci levels based on specific market conditions or strategies.

- Automation: Traders can automate alerts and trading decisions based on Fibonacci retracement levels.

- Backtesting: Pine Script enables users to backtest strategies using historical data, providing insights into the effectiveness of Fibonacci retracement in different market scenarios.

Tips for Effective Use

- Combine with Other Indicators: Use Fibonacci retracement in conjunction with other technical indicators for more robust trading signals.

- Adjust Levels: Experiment with different retracement levels to find what works best for your strategy.

- Monitor Market Conditions: Be aware of market trends and volatility when applying Fibonacci analysis.

Conclusion

Pine Script Fibonacci offers traders a powerful tool for enhancing their trading strategies. By understanding how to implement and customize Fibonacci retracement levels, traders can improve their market analysis and decision-making processes.