Pine Script: Closing Positions at End of Day

In the world of trading, managing positions effectively is crucial for minimizing risks and maximizing profits. One common strategy involves closing trades at the end of the day to avoid overnight risks. Pine Script, a powerful tool for creating trading strategies on platforms like TradingView, offers several ways to automate this process. Here’s how you can use Pine Script to close positions at the end of the day.

Understanding Pine Script Basics

Before diving into closing positions, it’s essential to understand the basics of Pine Script. This programming language allows users to create custom indicators and trading strategies directly on charts. With Pine Script, you can automate entry and exit points based on various conditions, including time-based criteria.

Closing Positions at End of Day

Closing positions at the end of the day is particularly useful for day traders who want to avoid overnight market risks. Here’s how you can achieve this using Pine Script:

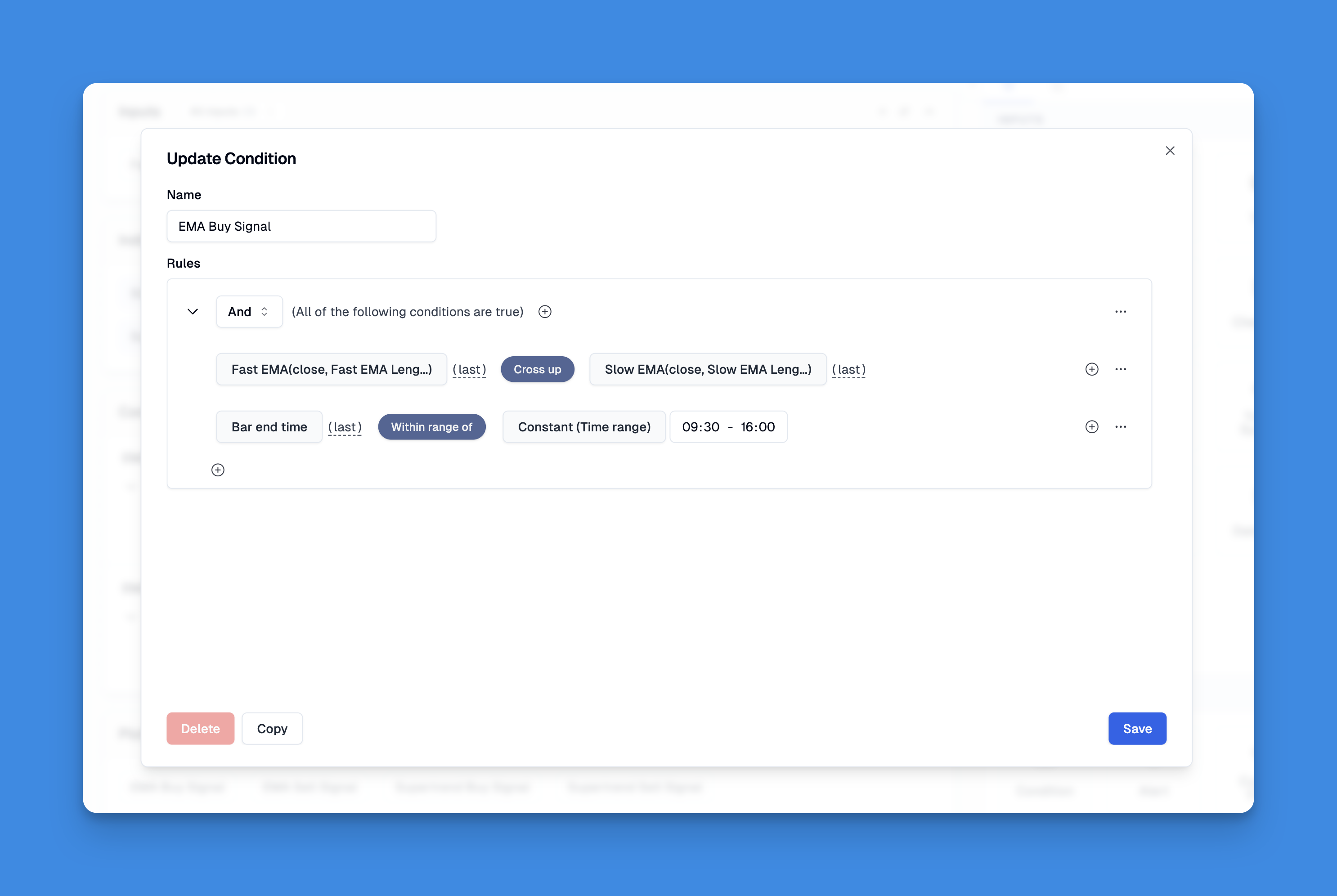

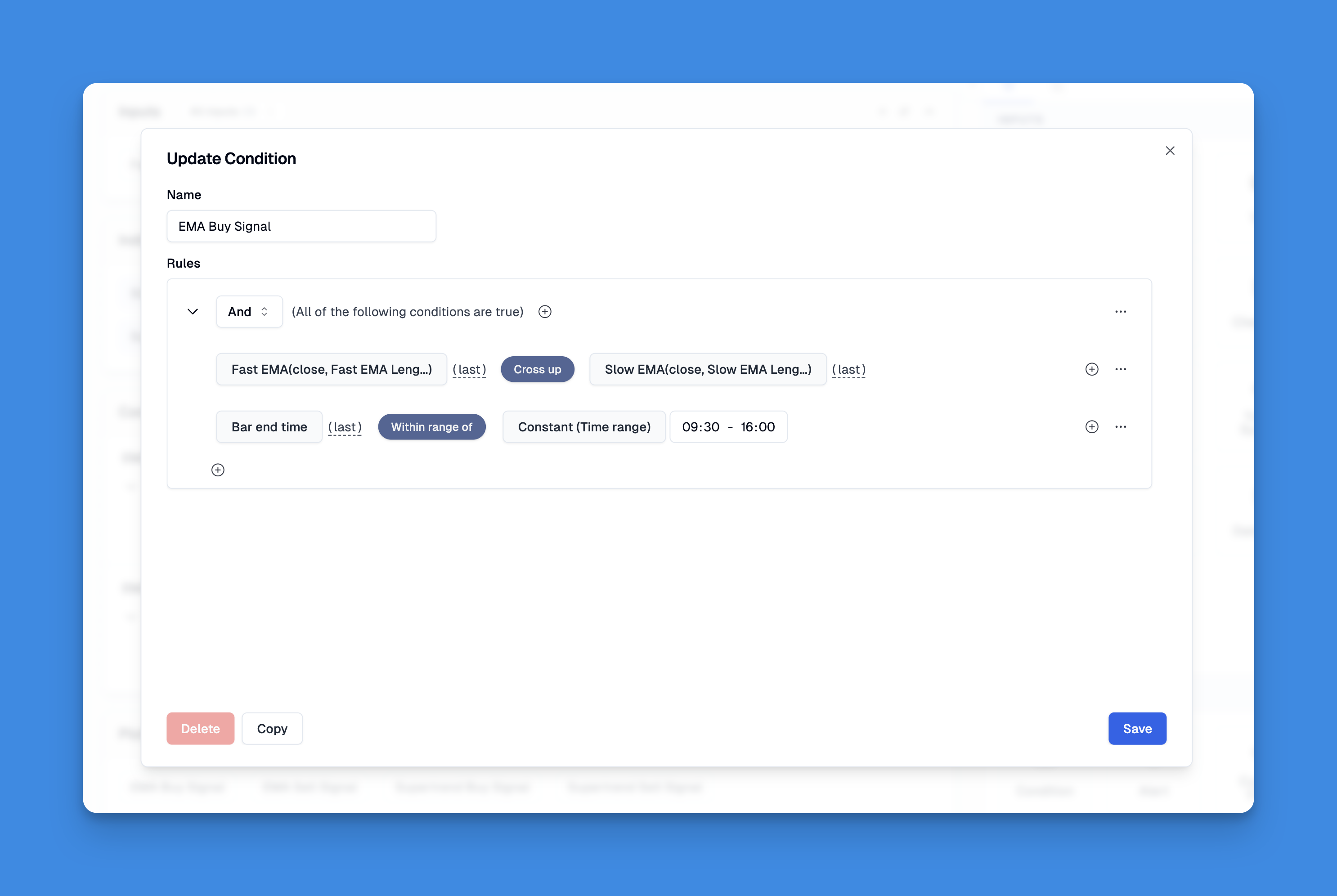

Streamlining End-of-Day Position Management with Pineify’s Visual Tools

Pineify revolutionizes position management by enabling traders to implement automated end-of-day closing rules without coding expertise. The platform’s intuitive Condition Editor allows strategic combination of technical indicators, price action patterns, and time-based triggers to execute precise exit logic.

Website: Pineify

Click here to view all the features of Pineify.Using strategy.close_all()

One of the simplest ways to close all open positions at the end of the day is by using the strategy.close_all() function. This function closes all current positions in your strategy.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

strategy('[Pineify - Best Pine Script Generator] End of Day Close', overlay = true)

// Function to check if it's the end of the day

isEndOfDay() =>

not na(time) and (year(timenow) != year(time) or month(timenow) != month(time) or dayofmonth(timenow) != dayofmonth(time))

// Close all positions at the end of the day

if isEndOfDay()

strategy.close_all(comment = 'End of Day Close')

Closing at a Specific Time

If you prefer to close positions at a specific time before the market closes, you can use the hour and minute functions to specify the exact time.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

strategy('[Pineify - Best Pine Script Generator] Close at Specific Time', overlay = true)

// Close all positions at 15:55 (3:55 PM)

if (hour == 15 and minute == 55)

strategy.close_all(comment="Pre-Market Close")

Benefits of Automating End-of-Day Closures

Automating end-of-day closures offers several benefits:

- Risk Management: Closing positions at the end of the day helps avoid overnight risks, such as gaps or unexpected market movements.

- Consistency: Automating this process ensures that you consistently close positions at the same time every day, reducing the need for manual intervention.

- Flexibility: You can adjust the closing time or conditions based on your trading strategy or market conditions.

Implementing Your Strategy

To implement these strategies, follow these steps:

- Open TradingView: Log into your TradingView account and navigate to the Pine Editor.

- Create a New Strategy: Start a new Pine Script by clicking on “New” and selecting “Strategy”.

- Paste Your Code: Copy and paste the code snippets above into the Pine Editor.

- Backtest Your Strategy: Use the backtesting feature to see how your strategy performs over historical data.

- Apply to Live Trading: Once satisfied with the results, apply your strategy to live trading.

Conclusion

Closing positions at the end of the day is a simple yet effective way to manage trading risks. By using Pine Script, you can automate this process and ensure consistent execution of your trading strategies. Whether you’re a seasoned trader or just starting out, automating end-of-day closures can help you refine your approach and potentially improve your trading outcomes.