Understanding Pine Script Offset: A Comprehensive Guide

Pine Script, the programming language used in TradingView, offers powerful tools for technical analysis. One such feature is the offset function, which allows traders to shift indicators and plot lines on charts. This article will explore how to effectively use offset in Pine Script to enhance your trading strategies.

What is Offset in Pine Script?

Offset in Pine Script is a parameter that allows you to shift plotted values horizontally on a chart. This can be particularly useful when:

- Comparing different timeframes

- Creating leading or lagging indicators

- Adjusting entry and exit points in trading strategies

How to Use Offset in Pine Script

To implement offset in your Pine Script code, follow these steps:

- Define your indicator or plot function

- Add the offset parameter to the plot function

- Specify the number of bars to shift (positive for right, negative for left)

Here’s a basic example:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Simple MA with Offset", overlay=true)

length = input(14, "MA Length")

offset = input(3, "Offset")

ma = ta.sma(close, length)

plot(ma, color=color.blue, linewidth=2, offset=offset)

In this code, we create a simple moving average and shift it 3 bars to the right.

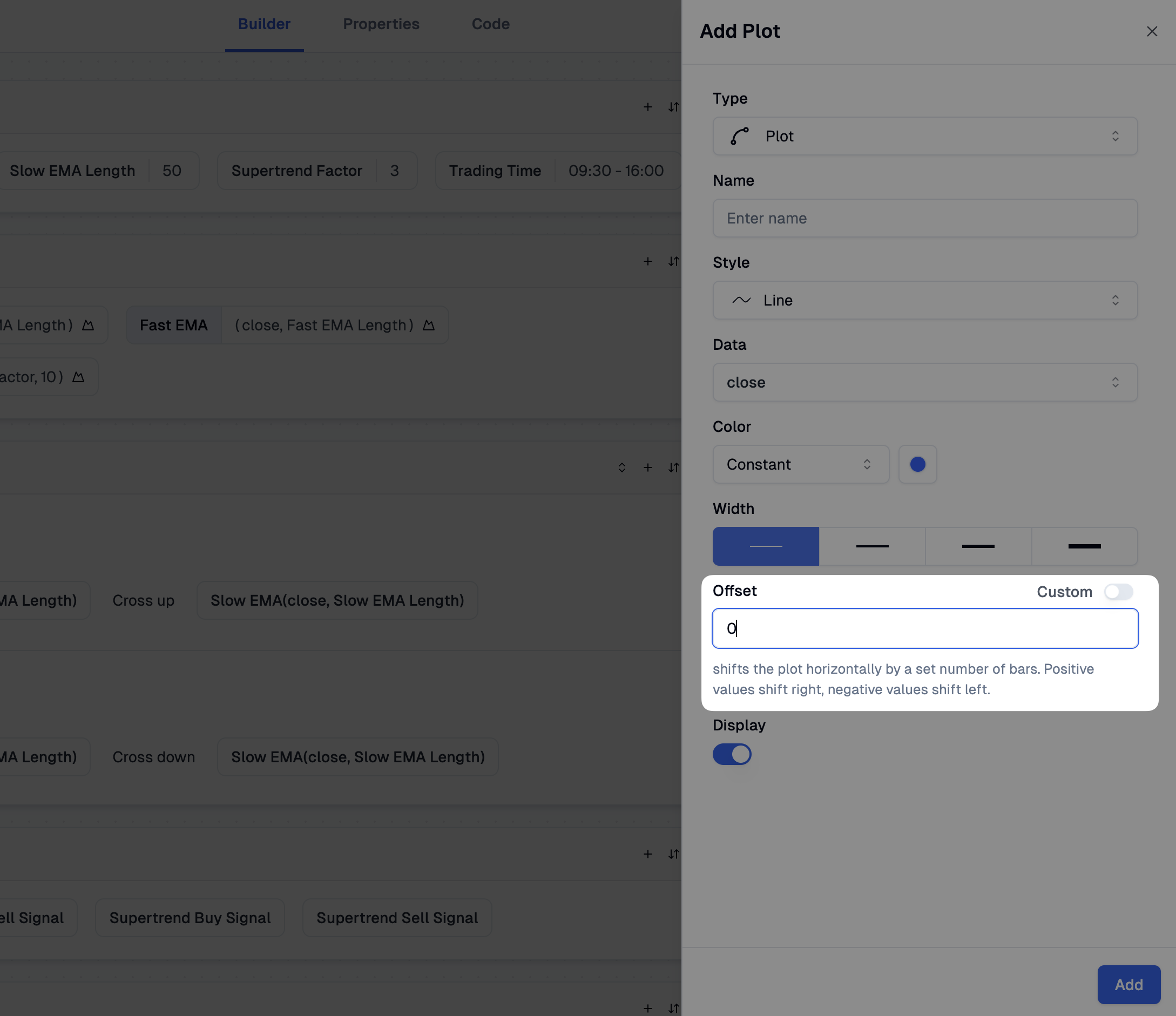

Leveraging Pineify for Customized Plot Offsets Without Coding

Pineify revolutionizes the way traders implement offset functionality in their technical indicators without requiring any Pine Script coding knowledge. While TradingView's native platform limits plot customization options for non-programmers, Pineify's intuitive visual interface makes offset adjustments accessible to everyone.

Through its comprehensive plotting system, users can create sophisticated time-shifted indicators by manipulating the temporal positioning of visualization elements including lines, histograms, background colors, and shapes1 This powerful feature enables traders to develop leading or lagging indicators that can anticipate market movements or confirm patterns after they've formed.

Advanced Offset Techniques

Offsetting Moving Averages

When working with multiple moving averages, you can create interesting crossover strategies by offsetting one or more of them:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator("[Pineify - Best Pine Script Generator] Multiple MAs with Offset", overlay=true)

ma1 = ta.sma(close, 5)

ma2 = ta.sma(close, 14)

ma3 = ta.sma(close, 200)

plot(ma1, color=color.red, linewidth=2)

plot(ma2, color=color.blue, linewidth=2, offset=3)

plot(ma3, color=color.green, linewidth=2)

This script plots three moving averages, with the 14-period MA offset by 3 bars.

Using Offset for Entry Points

Offset can be used to fine-tune entry points in trading strategies. For example, you might want to enter a trade a few bars after a signal is generated:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

strategy("[Pineify - Best Pine Script Generator] Offset Entry Strategy", overlay=true)

ma_fast = ta.sma(close, 10)

ma_slow = ta.sma(close, 20)

crossover = ta.crossover(ma_fast, ma_slow)

if (crossover[^3]) // Check for crossover 3 bars ago

strategy.entry("Long", strategy.long)

This strategy enters a long position 3 bars after a moving average crossover occurs.

Best Practices for Using Offset

- Understand the impact: Offsetting can change the timing of signals, so always backtest your strategies thoroughly.

- Use appropriate values: Large offset values may lead to look-ahead bias or unrealistic results.

- Combine with other techniques: Offset works well when combined with other Pine Script features like security() for multi-timeframe analysis.

Conclusion

Mastering the offset function in Pine Script can significantly enhance your trading indicators and strategies. By shifting plots and entry points, you can create more sophisticated and potentially more profitable trading systems. Experiment with different offset values and combine them with other Pine Script features to develop unique and effective trading tools.