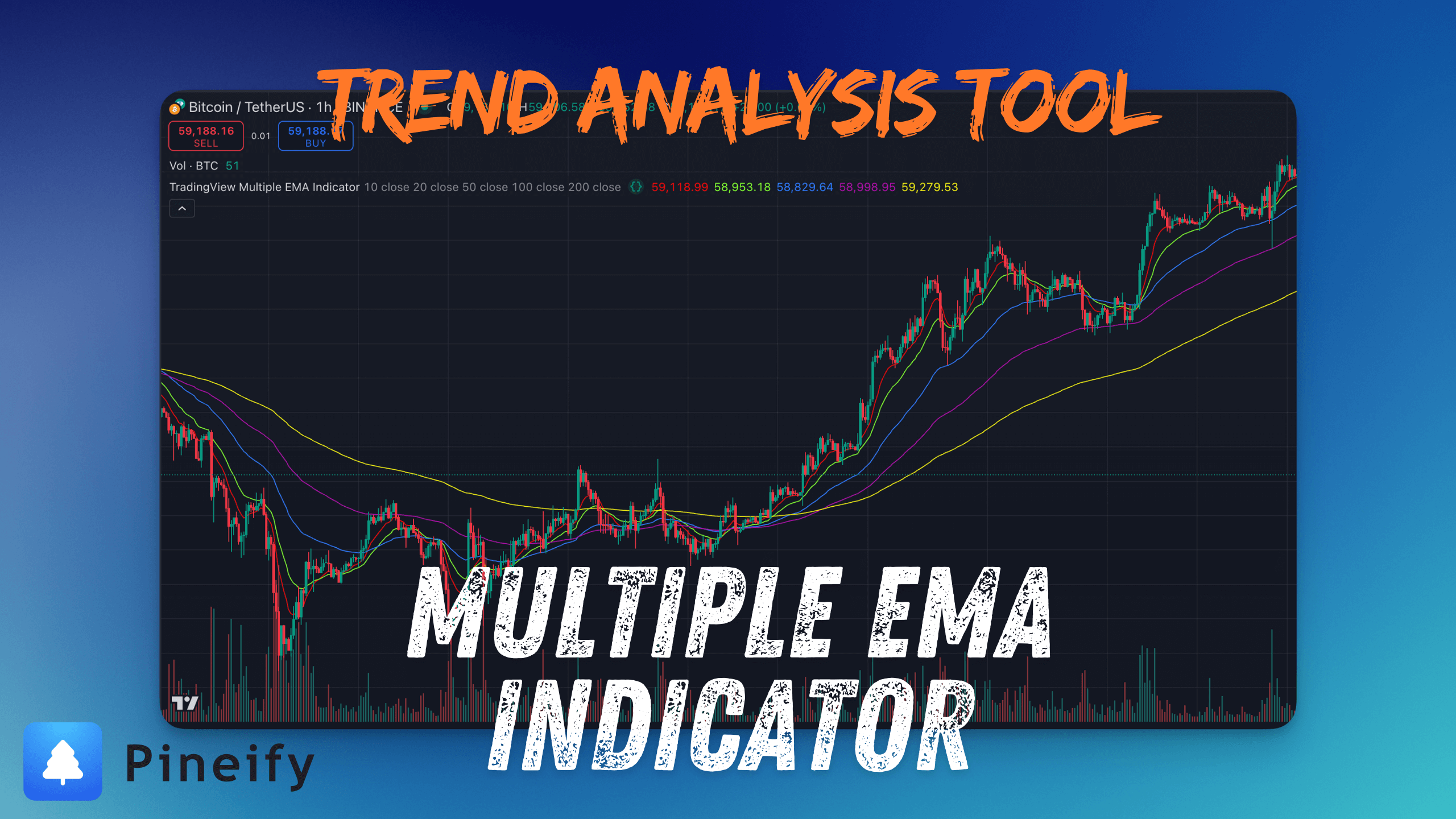

Multiple EMA Indicator: Unlocking Market Trends

The TradingView Multiple EMA Indicator is a powerful and versatile tool designed to provide traders with a comprehensive view of market trends across multiple timeframes. By combining five customizable Exponential Moving Averages (EMAs), this indicator offers a unique approach to trend analysis, allowing traders to make more informed decisions based on a holistic view of price action.

👉 Copy Indicator Script

👉 Copy Indicator Script

Key Features

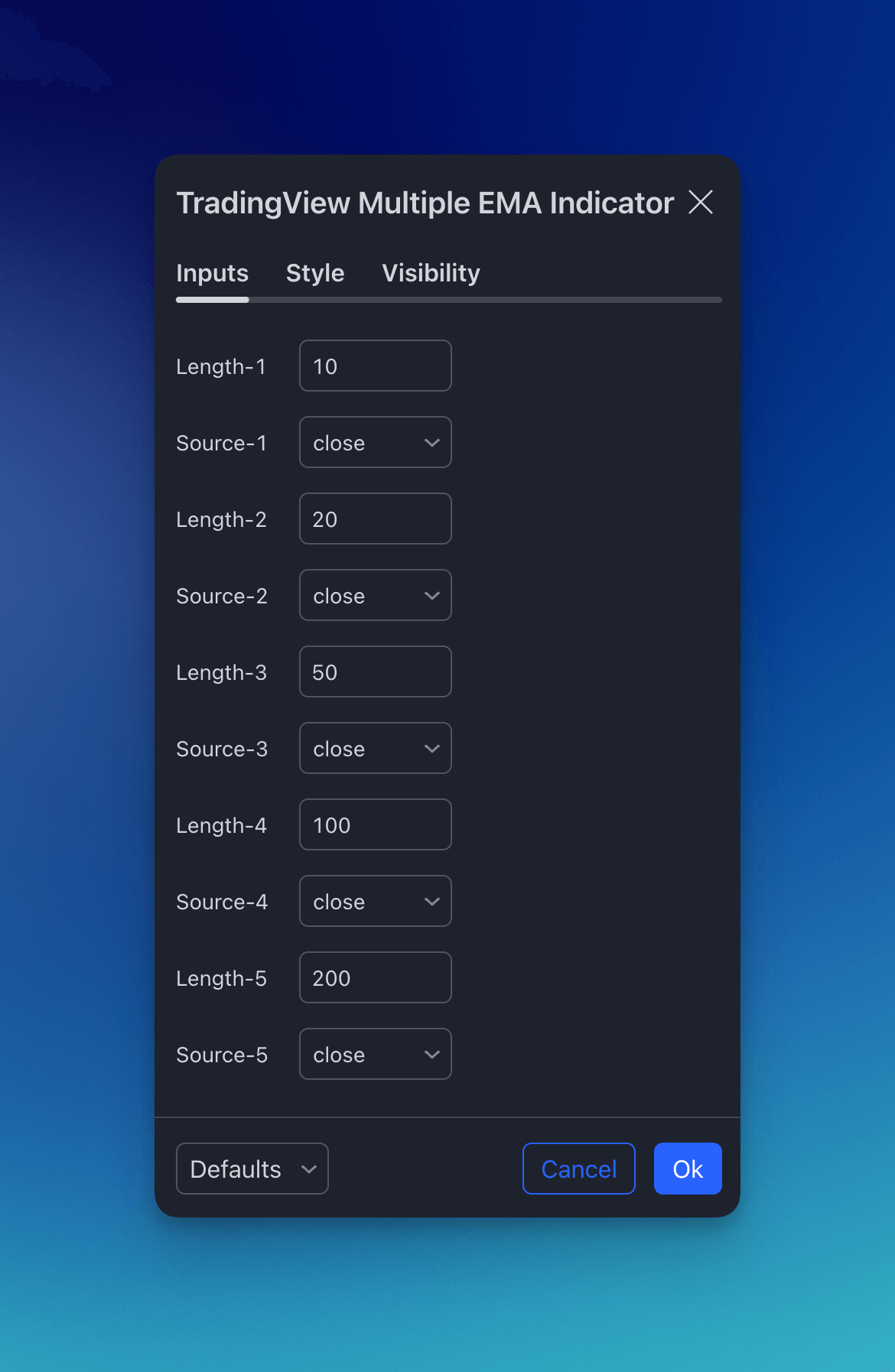

- Five Customizable EMAs: The indicator plots five separate EMAs on your chart, each with adjustable length and source inputs. This allows for a multi-faceted analysis of trends across different timeframes.

- Flexible Source Selection: For each EMA, you can choose the price source (open, high, low, close) that best fits your trading strategy, providing a tailored approach to trend identification.

- Color-Coded Visualization: Each EMA is represented by a distinct color, making it easy to differentiate between different trend lines at a glance.

- Overlay Functionality: The indicator overlays directly on your price chart, allowing for seamless integration with other technical analysis tools and indicators.

How It Works

The indicator calculates and plots five EMAs based on user-defined parameters:

- EMA-1: Red line (default length: 10)

- EMA-2: Green line (default length: 20)

- EMA-3: Blue line (default length: 50)

- EMA-4: Purple line (default length: 100)

- EMA-5: Yellow line (default length: 200)

By default, all EMAs use the closing price as their source, but this can be easily customized in the indicator settings.

Trading Ideas and Insights

- Trend Strength: When shorter-term EMAs (EMA-1 and EMA-2) are above longer-term EMAs (EMA-4 and EMA-5), it indicates a strong uptrend. The reverse suggests a strong downtrend.

- Trend Reversals: Watch for crossovers between shorter and longer-term EMAs. For example, EMA-1 crossing above EMA-5 could signal the start of a new uptrend.

- Support and Resistance: EMAs often act as dynamic support and resistance levels. Price bouncing off a particular EMA can be a sign of trend continuation.

- Multiple Timeframe Analysis: Use the different EMAs to analyze trends across various timeframes simultaneously. This can help identify potential entry and exit points that align with both short-term and long-term trends.

- Volatility Assessment: The spacing between EMAs can indicate market volatility. Wider spacing suggests higher volatility, while tighter spacing indicates lower volatility.

- Golden Cross and Death Cross: Pay attention to crossovers between EMA-3 (50-period) and EMA-5 (200-period). A golden cross (50 crosses above 200) is traditionally bullish, while a death cross (50 crosses below 200) is bearish.

How to Use

- Add the indicator to your chart.

- Adjust the length and source for each EMA in the indicator settings to match your preferred timeframes and analysis style.

- Observe the relative positions of the EMAs and their interactions with price action.

- Use the insights gained from the Multiple EMA Indicator in conjunction with other technical analysis tools and fundamental research to make informed trading decisions.

This Multiple EMA Indicator stands out from traditional moving average indicators by providing a comprehensive, multi-timeframe approach to trend analysis. By visualizing five customizable EMAs simultaneously, traders can gain deeper insights into market trends, potential reversals, and areas of support and resistance. This versatility makes it an invaluable tool for both novice and experienced traders across various trading styles and timeframes.

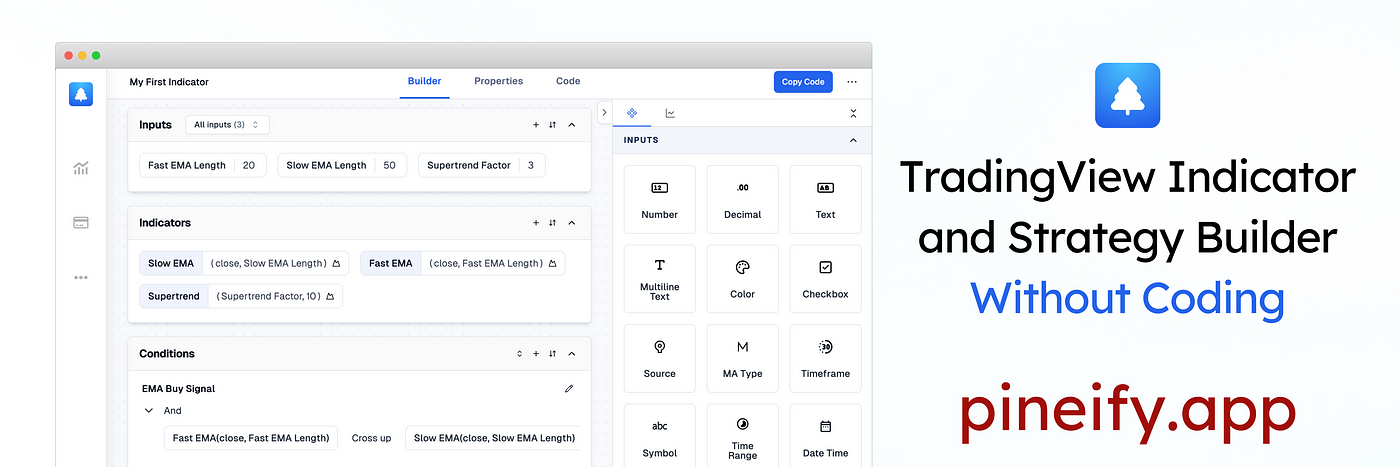

Pineify: TradingView Pine Script Indicator & Strategy Generator

With Pineify, you can efficiently generate buy/sell indicators and custom strategies for TradingView Pine Script code creator. The best indicator and strategy backtest builder.

And you can easily create your own indicators and strategies without any coding skills, saving both time and money on freelancers.

TradingView Indicator & Strategy Generator: https://pineify.app/