Enhancing TradingView Charts with Pine Script Bar Colors

In the world of trading, visual cues are crucial for making informed decisions quickly. Pine Script, a powerful programming language used in TradingView, allows users to customize their charts with dynamic bar colors, enhancing the analysis process. This article explores how to leverage the Pine Script bar color feature to create more intuitive and effective trading charts.

Introduction to Pine Script Bar Colors

Pine Script offers a versatile toolset for customizing charts, including the ability to change bar colors based on specific conditions. This feature is particularly useful for highlighting trends, patterns, or trading signals directly on the chart. By using the barcolor function, users can create visually appealing and informative charts that aid in swift decision-making.

Understanding the barcolor Function

The barcolor function in Pine Script is designed to color bars based on various criteria. It allows users to define the color, offset, editability, and display settings for the colored bars. Here’s a breakdown of its parameters:

- Color: Defines the color of the bars. This can be a constant like

color.redor a conditional expression. - Offset: Shifts the color series by a specified number of bars.

- Editable: Determines if the bar color style can be edited in the Format dialog.

- Show Last: Specifies the number of bars to fill from the last bar back.

- Title: Titles the bar color for identification.

- Display: Controls where the bar color is displayed.

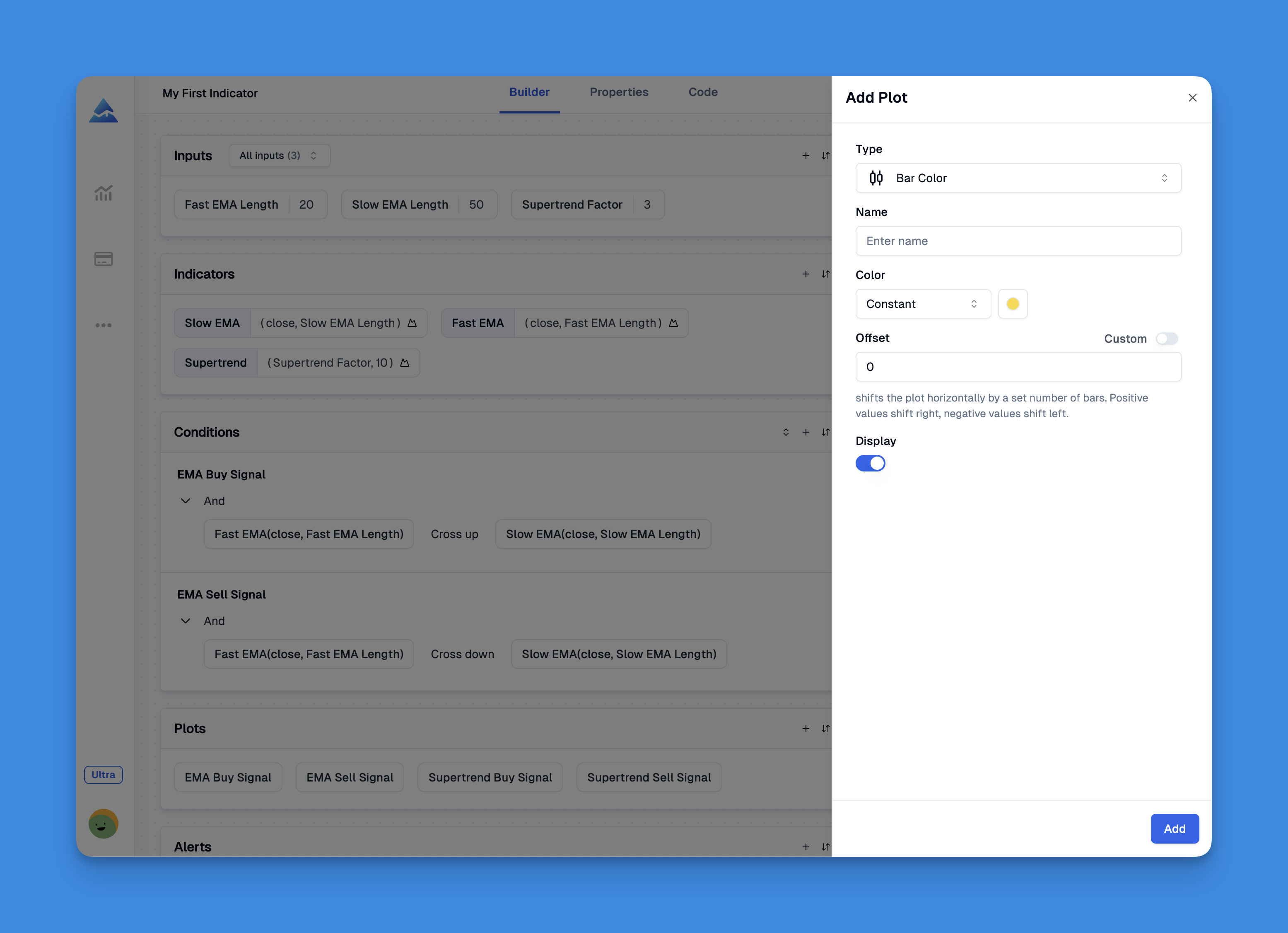

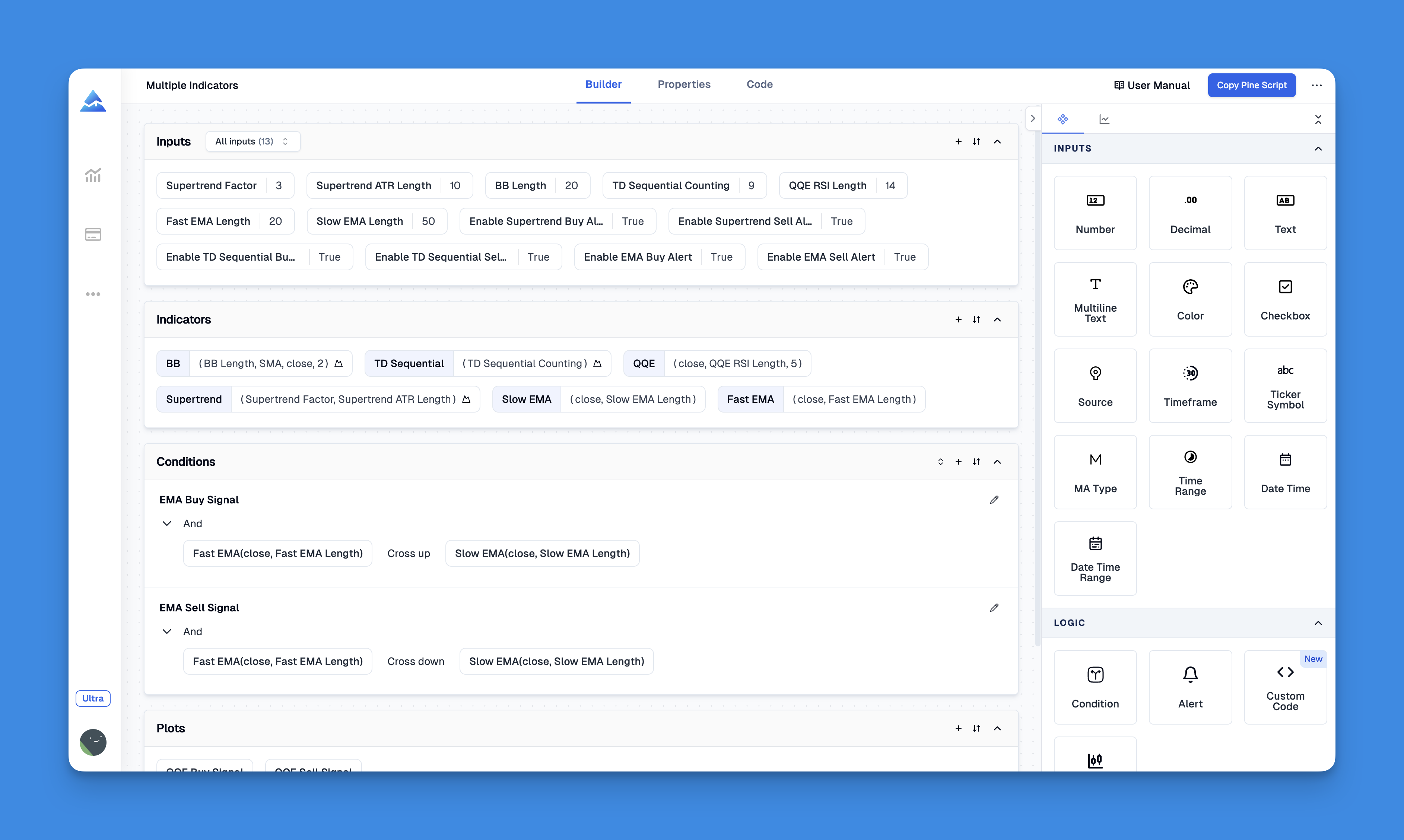

Transform Your TradingView Charts with Dynamic Pine Script Bar Colors Using Pineify's No-Code Solutions

Website: Pineify

ineify revolutionizes how traders implement Pine Script bar coloring strategies through its intuitive visual interface. This platform enables effortless creation of candlestick pattern visualizations without writing a single line of code, making complex technical analysis accessible to all TradingView users.

With Pineify's Lifetime plan ($259 one-time), traders gain permanent access to advanced bar coloring features that would normally require $400+ in freelance coding costs. The platform's visual approach reduces setup time from hours to minutes.

Example Use Case: Coloring Bars Based on SMA

One common use case is coloring bars based on their position relative to a Simple Moving Average (SMA). Here’s how you can implement this:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator('[Pineify - Best Pine Script Generator] SMA Barcolor Example', overlay = true)

sma14 = ta.sma(close, 14)

barcolor(close > sma14 ? color.green : color.red)

plot(sma14)

This script colors bars green if the closing price is above the SMA and red if it’s below, providing a clear visual indication of price movements relative to the SMA.

Benefits of Custom Bar Colors

Customizing bar colors with Pine Script offers several benefits:

- Enhanced Visual Clarity: By highlighting specific conditions, traders can quickly identify trends or patterns.

- Improved Decision Making: Visual cues help in making faster and more informed trading decisions.

- Flexibility: Users can tailor the colors to suit their trading strategies or preferences.

Tips for Effective Use

To maximize the effectiveness of custom bar colors:

- Use Conditional Logic: Apply colors based on specific conditions, such as price movements or technical indicators.

- Experiment with Different Colors: Choose colors that are visually distinct and easy to interpret.

- Combine with Other Indicators: Use bar colors in conjunction with other indicators for a comprehensive view.

Conclusion

Customizing bar colors in Pine Script is a powerful way to enhance your trading experience. Whether you’re a seasoned trader or just starting out, leveraging this feature can significantly improve your chart analysis.