Strategy

On TradingView, if you want to view the returns of an indicator, you need to create a strategy rather than an indicator. A strategy can be understood as an indicator with backtesting capabilities.

On the Pineify platform, each Strategy corresponds to a Pine Script. Next, we will explore how to create these strategies.

How to Create Strategies

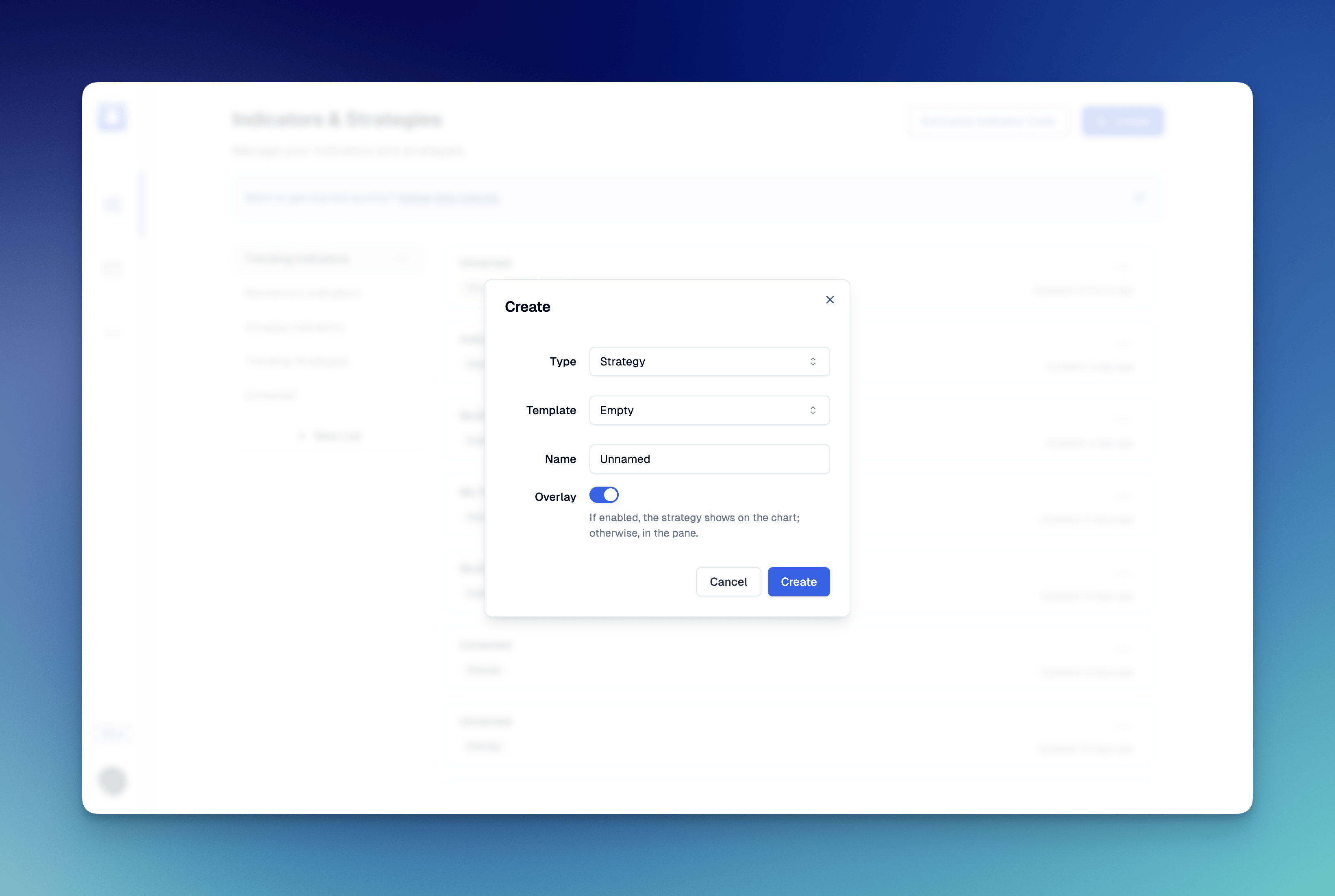

Open the Pineify homepage, click the "Create" button in the top right corner, select the strategy type, then click "Create". The specific steps are shown in the image below.

If Overlay is enabled, the strategy will be displayed on the main chart pane. If you want to display it on a separate panel, you need to disable Overlay.

After successful creation, you will see the strategy's editor interface.

Strategy Properties

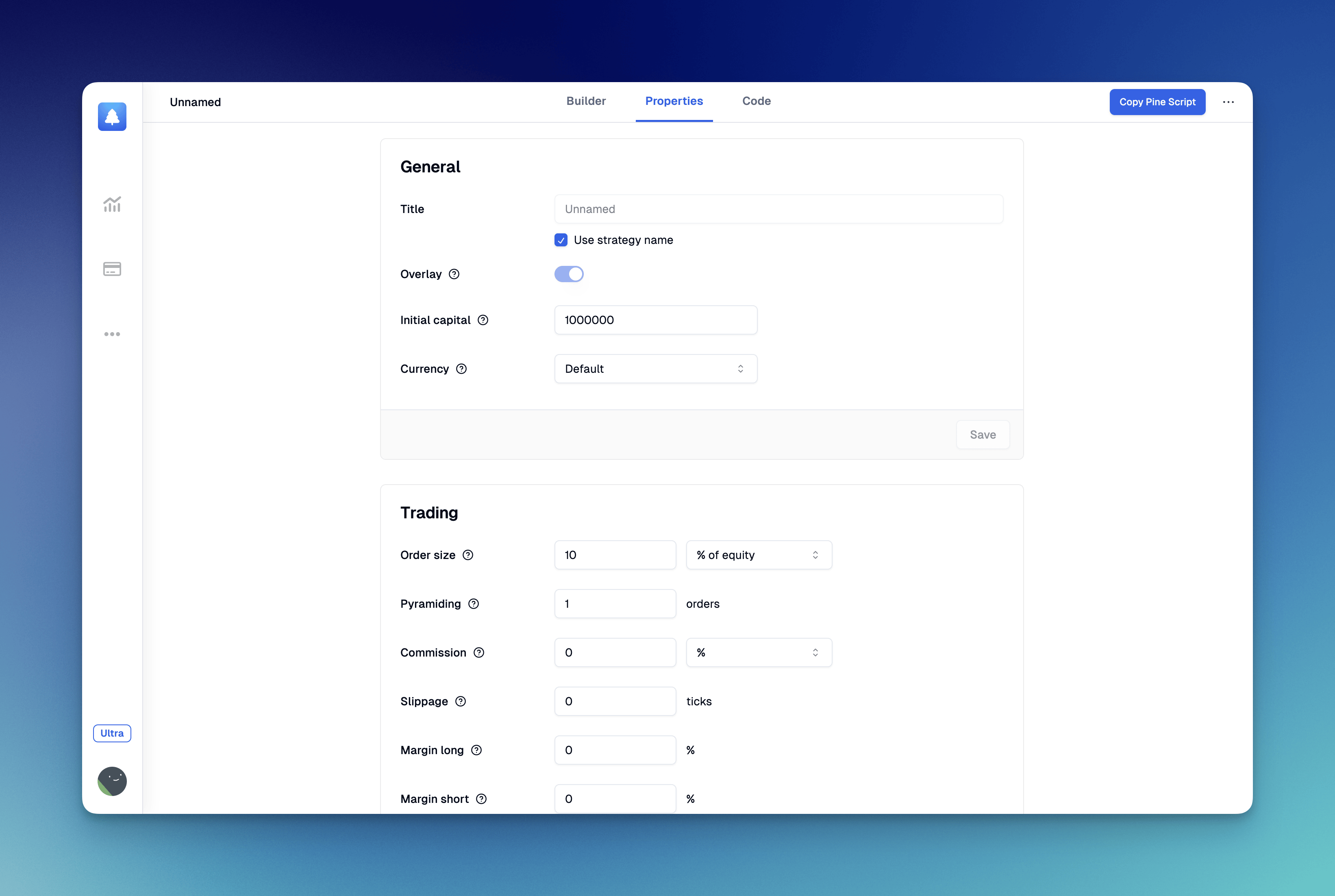

Switch to the Properties Tab, and you can see the properties of the current strategy.

The following properties are currently supported for configuration:

General

- Name: The title displayed for the strategy on the chart.

- Overlay: Controls whether the strategy is displayed on the main chart pane. This setting cannot be modified after the strategy is created.

- Initial capital: The amount of funds initially available for the strategy to trade.

- Currency: Currency used in calculations and strategy results.

Trading

- Order size: The number of contracts/shares/lots/units per trade, or the amount in base currency, or a percentage of available equity.

- Pyramiding: Maximum number of successive entries allowed in the same direction.

- Commission: Fees charged for each trade execution, applied to both entry and exit orders.

- Slippage: The amount in ticks to be added to the fill price of market or stop orders.

- Margin long: The percentage of equity required to fund long positions.

- Margin short: The percentage of equity required to fund short positions.

Recalculate

- After order is filled: Enables an additional intrabar calculation immediately after an order fills.

- On every tick: Recalculates the strategy on each update of real-time bars.

Fill orders

- Using bar magnifier: On historical bars, uses more precise lower timeframe prices for more realistic results.

- On bar close: Fills market orders on the close of the bar where they are issued.