List view

Overview

Overview

Price Data

Price Data

Script Types

Strategy

On TradingView, to view an indicator's returns, you need to create a strategy instead of an indicator. A strategy can be thought of as an indicator with backtesting capabilities.

On the Pineify platform, each Strategy corresponds to a Pine Script. Let's explore how to create these strategies.

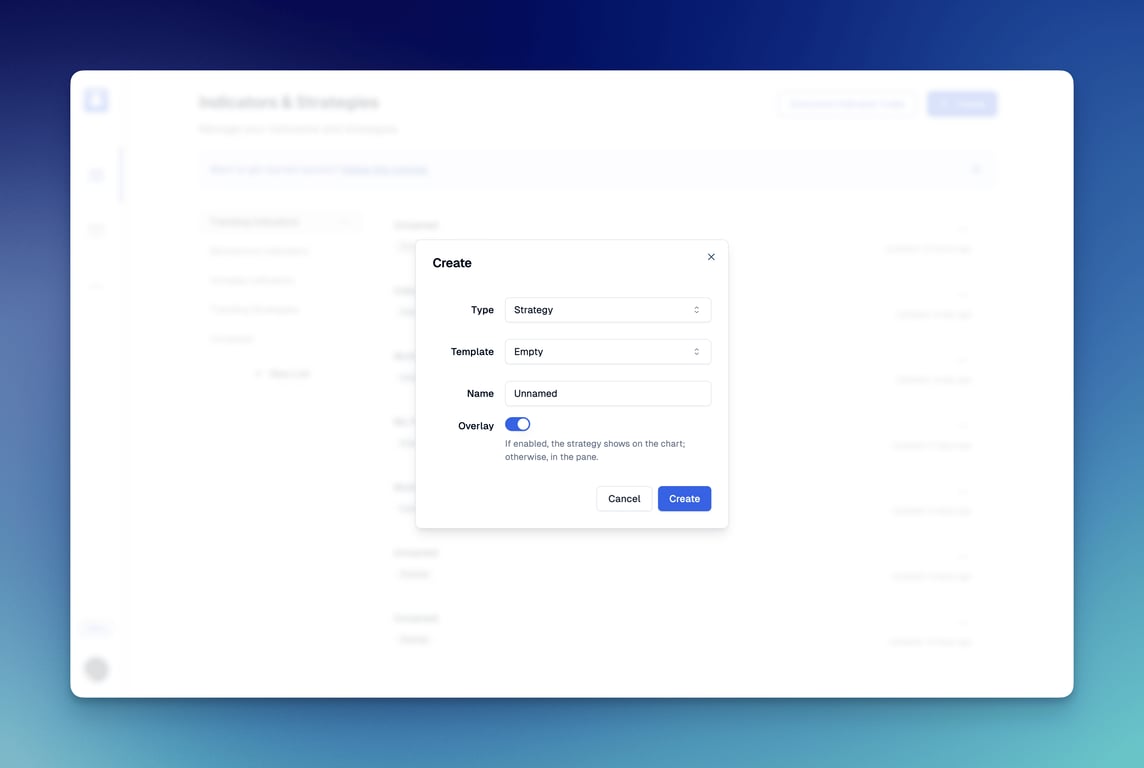

To create a strategy, follow these steps:

- Visit the Pineify homepage

- Click the "Create" button in the top right corner

- Select the strategy type

- Click "Create"

The image below illustrates this process.

When Overlay is enabled, the strategy appears on the main chart pane. To display it on a separate panel, disable Overlay.

Once created successfully, you'll see the strategy's editor interface.

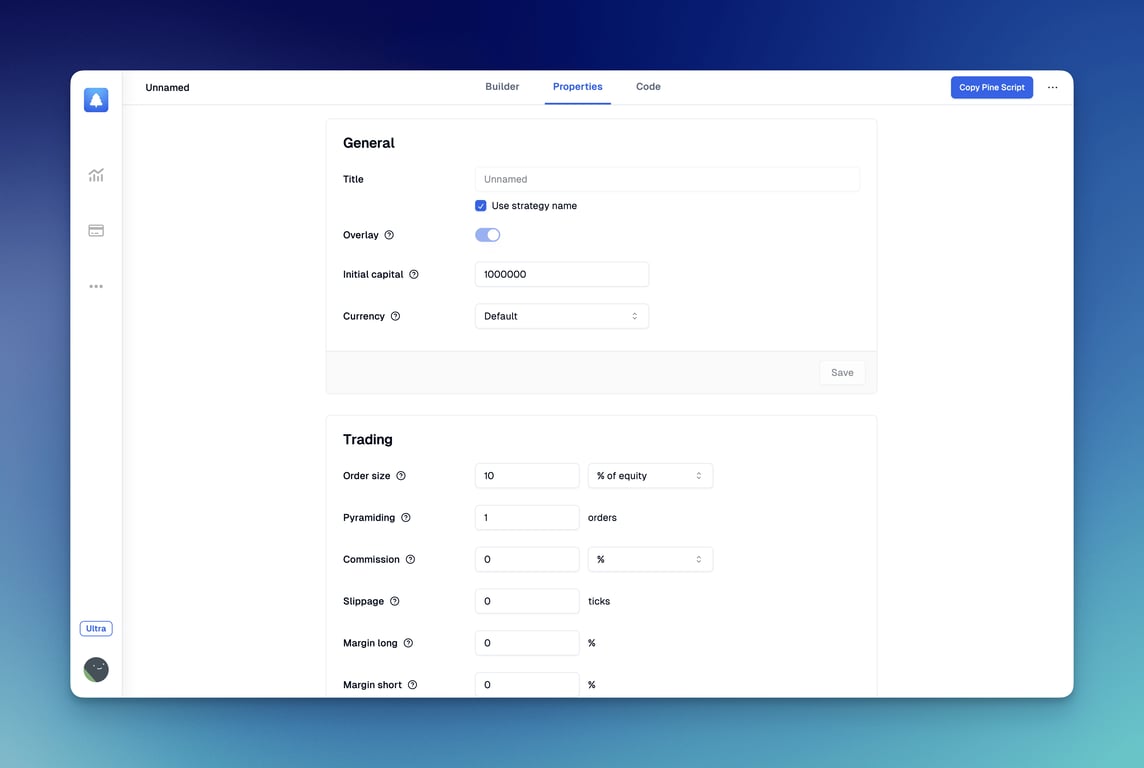

Strategy Properties

Switch to the Properties tab to view the current strategy's properties.

The following properties are available for configuration:

General

- Name: The title shown for the strategy on the chart.

- Overlay: Determines if the strategy appears on the main chart pane. This can't be changed after creation.

- Initial capital: The starting funds available for the strategy to trade.

- Currency: The currency used for calculations and strategy results.

Trading

- Order size: The quantity of contracts/shares/lots/units per trade, or the amount in base currency, or a percentage of available equity.

- Pyramiding: The maximum number of consecutive entries allowed in the same direction.

- Commission: The fees charged for each trade, applied to both entry and exit orders.

- Slippage: The number of ticks added to the fill price of market or stop orders.

- Margin long: The percentage of equity needed to fund long positions.

- Margin short: The percentage of equity needed to fund short positions.

Recalculate

- After order is filled: Triggers an extra intrabar calculation right after an order fills.

- On every tick: Updates the strategy calculations with each new tick in real-time bars.

Fill orders

- Using bar magnifier: Uses more detailed lower timeframe prices on historical bars for more accurate results.

- On bar close: Executes market orders at the close of the bar in which they're issued.